In the dynamic and detail-oriented field of Accounting & Finance, standing out as a Collections Representative requires more than just a knack for numbers. It demands a resume that not only showcases your expertise in managing and recovering assets but also highlights your soft skills in negotiation and customer service. Crafting such a resume can seem daunting, but with the right guidance, you can present a compelling picture of your professional prowess. Whether you're a seasoned veteran in the collections industry or looking to make your mark, this guide is your roadmap to a resume that resonates with recruiters.

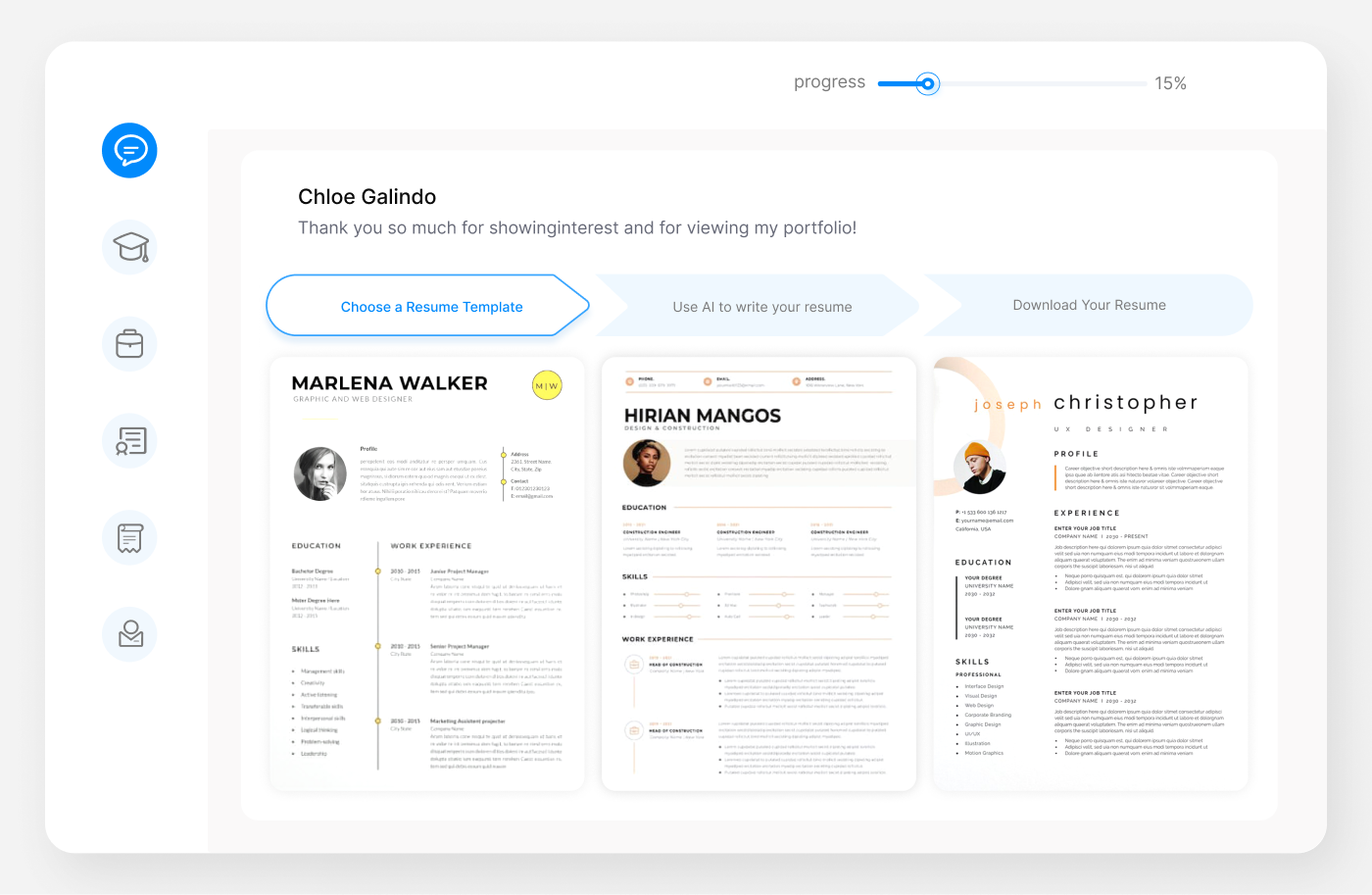

Collections Representative Resume Example

Cameron Diaz

Los Angeles, CA | (310) 555-1234

cameron.diaz@email.com | LinkedIn: /in/cameron-diaz

Professional Summary

Dedicated Collections Representative with over 5 years of experience in the finance sector, specializing in debt recovery and customer relationship management. Proven track record in reducing delinquencies and improving cash flow for major financial institutions, including Bank of America and Wells Fargo. Skilled in negotiation, conflict resolution, and developing effective payment plans. Committed to maintaining positive customer experiences while achieving financial objectives.

Work Experience

Senior Collections Representative

Wells Fargo, Los Angeles, CA

July 2020 - Present

- Spearheaded a team of 10 representatives, reducing the delinquency rate by 25% within the first year through strategic collection efforts and personalized payment solutions.

- Developed and implemented an innovative training program that improved team performance metrics by 40%.

- Negotiated and settled accounts totaling over $2M, maintaining a 95% customer satisfaction rate.

Collections Representative

Bank of America, San Francisco, CA

June 2018 - June 2020

- Managed a portfolio of 500+ accounts, successfully recovering $1.5M in outstanding debt.

- Enhanced customer retention by 15% through the development of flexible payment arrangements tailored to individual financial situations.

- Collaborated with the legal department to prepare and execute legal proceedings for delinquent accounts, resulting in a 20% reduction in outstanding debts.

Education

Bachelor of Science in Finance

University of California

Berkeley, CA | May 2018

Skills

- Debt Recovery

- Negotiation and Conflict Resolution

- Customer Relationship Management

- Financial Analysis

- Regulatory Compliance

- Team Leadership and Training

Certifications

- Certified Receivables Professional (CRP)

- Fair Debt Collection Practices Act (FDCPA) Compliance Certification

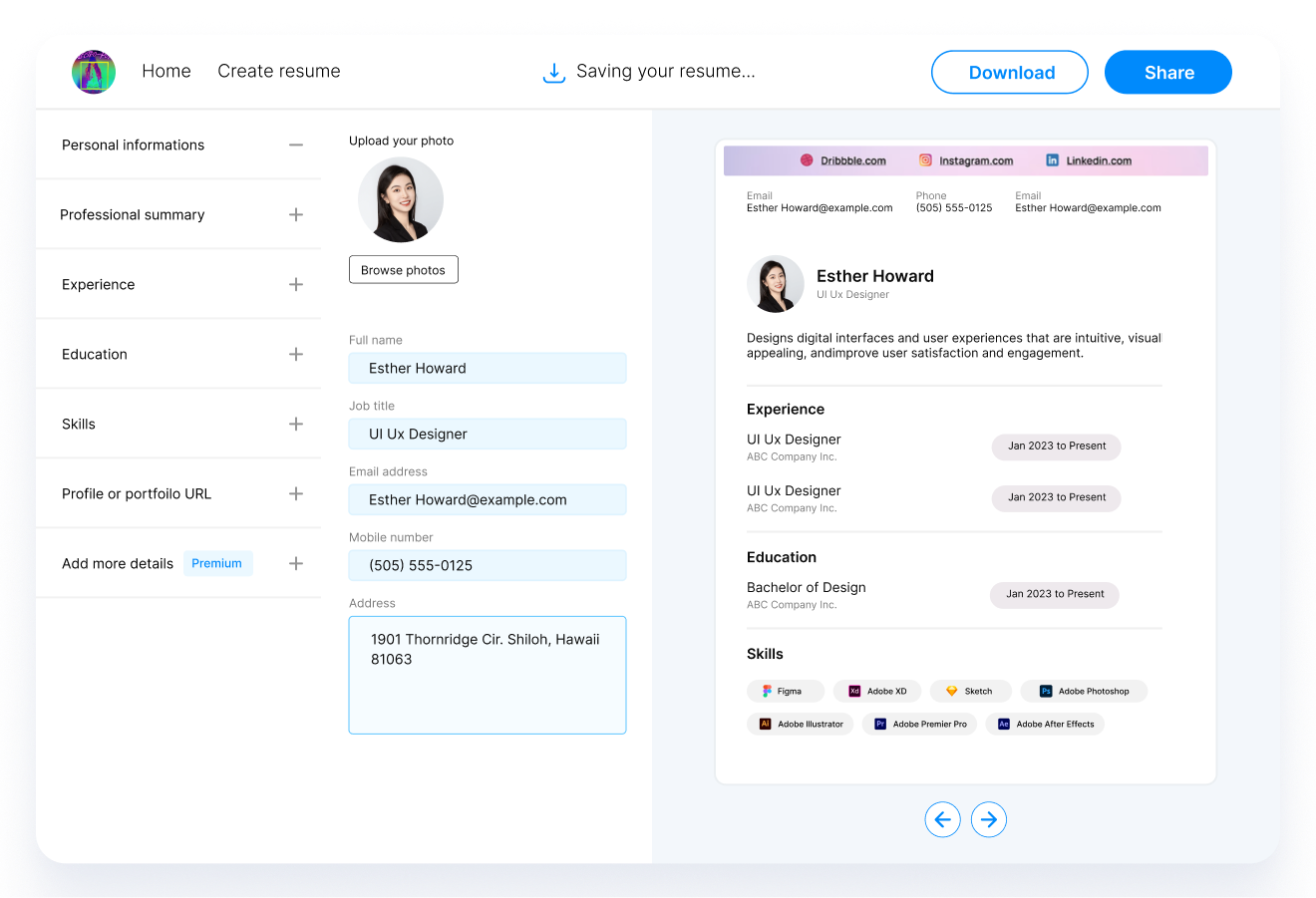

Crafting the Perfect Collections Representative Resume Structure

When it comes to assembling your Collections Representative resume, clarity, and organization are paramount. Your resume is essentially your professional narrative, and the way you structure this story can significantly impact your job search's success. Here’s how to structure your resume for maximum impact:

1. Choose the Right Resume Format:

Start by selecting a format that best highlights your strengths. The most common formats are chronological, functional, and combination. For Collections Representatives, a chronological format is often most effective, as it showcases your progression and depth in the finance and collections field.

2. The Power of a Professional Summary:

Immediately following your contact information, a well-crafted professional summary can set the tone for your entire resume. This section should concisely highlight your years of experience, key skills, and major achievements. Think of it as your elevator pitch to potential employers.

3. Detailing Your Work Experience:

This section is the backbone of your resume. List your experiences in reverse chronological order, focusing on achievements rather than daily tasks. Use bullet points to detail how you've contributed to past employers, including any improvements in collection rates, customer satisfaction, or efficiency gains. Quantifying your accomplishments with numbers adds credibility and a sense of scale to your achievements.

4. Education and Continuous Learning:

Even though hands-on experience plays a significant role in the collections field, your educational background is also important. List your degrees, certifications, and relevant training. Highlight any specific coursework related to finance, negotiations, or communication that could be beneficial in a collections role.

5. Emphasizing Your Skills:

The skills section is your opportunity to highlight both your hard and soft skills. For a Collections Representative, important skills might include debt recovery, negotiation, customer service, financial analysis, and knowledge of relevant laws and regulations. Tailor this section to match the skills mentioned in the job listing you're applying for.

6. Adding Value with Additional Sections:

Consider including additional sections if they add value to your resume. This might include certifications, professional associations, languages, or volunteer work. For example, being a Certified Receivables Professional (CRP) or having completed training in Fair Debt Collection Practices Act (FDCPA) compliance can be particularly appealing to employers.

Formatting Tips:

- Keep your resume to one page if possible, especially if you have less than 10 years of experience.

- Use a clean, professional font and ensure your layout is easy to read.

- Be consistent with your formatting choices (e.g., bullet points, dates, and headings).

- Proofread meticulously to avoid typos and grammatical errors.

Crafting a Compelling Resume Summary or Objective for Collections Representatives

The resume summary or objective is more than just a few lines of text at the top of your Collections Representative resume—it's your first opportunity to grab the attention of a hiring manager. Crafting a compelling and insightful summary or objective can significantly influence your resume's effectiveness. Here's how to make yours stand out:

The Importance of a Strong Summary

A resume summary is ideal for professionals with a substantial background in collections or finance. It should succinctly encapsulate your years of experience, key achievements, and the unique skills you bring to the table. The goal is to quickly convey your value as a candidate in just a few sentences.

Example Summary:

Professional Summary:

Dynamic Collections Representative with over 7 years of experience in fast-paced financial environments. Proven track record of exceeding collection targets through effective negotiation and customer relationship management. Adept at creating win-win solutions that enhance client satisfaction and optimize revenue recovery. Recognized for outstanding communication skills and the ability to mentor and lead teams towards achieving corporate goals.

When to Use a Resume Objective

Alternatively, a resume objective might be more suitable if you're new to the field, making a career change, or have gaps in your employment. This section should focus on your career goals and how they align with the position you're applying for, highlighting your relevant skills and how you plan to apply them.

Example Objective:

Resume Objective:

Energetic and motivated professional transitioning into the financial sector, with a strong foundation in customer service and conflict resolution. Seeking to leverage interpersonal skills and a keen analytical acumen as a Collections Representative at [Company Name]. Committed to supporting team objectives while pursuing opportunities for professional development and mastery in debt collection strategies.

Tailoring Your Summary or Objective

Regardless of which option you choose, tailor your summary or objective to the job description. Use keywords and phrases from the job posting, and align your professional strengths with the specific requirements and objectives of the role you're applying for.

- Highlight Specific Skills: Mention specific skills that are crucial for a Collections Representative, such as negotiation, customer service, and knowledge of collection laws.

- Quantify Achievements: If possible, include quantifiable achievements (e.g., "Reduced delinquencies by 30% within the first year").

- Be Concise and Compelling: Keep it brief, but make every word count. Your summary or objective should entice the hiring manager to read the rest of your resume.

Your resume summary or objective is the first impression you'll make on a potential employer, so it's crucial to make it impactful. By focusing on your key strengths and aligning them with the needs of the employer, you'll set the stage for the rest of your resume to shine.

Showcasing Work Experience on Your Collections Representative Resume

The Work Experience section is the heart of your Collections Representative resume. It’s where you illustrate your career trajectory and highlight your achievements. Here's how to craft this section to showcase your value effectively:

1. Structure Your Experiences Clearly

Organize your work history in reverse chronological order, starting with your most recent position. For each role, include your job title, the company’s name, location, and your tenure. This clear structure helps recruiters quickly grasp your career progression.

2. Highlight Your Achievements, Not Just Duties

Instead of listing your daily tasks, focus on your accomplishments. Use action verbs to start each bullet point, and quantify your achievements whenever possible. This approach shifts the focus from what you were supposed to do to what you actually accomplished.

Example of Highlighting Achievements:

Collections Specialist

Financial Services Inc.

New York, NY | March 2019 - Present

- Spearheaded a cross-functional initiative to streamline the collections process, reducing average resolution time by 20%.

- Negotiated and settled over $4 million in delinquent accounts, consistently exceeding monthly targets by at least 15%.

- Implemented a new CRM system for tracking communications with clients, improving efficiency and customer satisfaction.

3. Use Keywords and Industry-Specific Language

Incorporate terminology and keywords from the collections and finance industry, especially those listed in the job posting. This strategy not only shows your expertise but also helps your resume pass through Applicant Tracking Systems (ATS).

4. Demonstrate Your Soft Skills

While technical skills are crucial, don't overlook your soft skills. Collections Representatives need excellent communication, negotiation, and problem-solving skills. Highlight instances where these skills helped you overcome challenges or achieve goals.

Example of Demonstrating Soft Skills:

Junior Collections Officer

ABC Bank, Los Angeles, CA

January 2017 - February 2019

- Enhanced client relations by developing personalized payment solutions, resulting in a 30% increase in successful debt recoveries.

- Awarded "Employee of the Month" for exceptional customer service and dedication to maintaining positive client relationships.

5. Tailor Your Experience for the Role

Customize this section for each application. Emphasize the experiences and achievements most relevant to the Collections Representative position you're applying for. This shows prospective employers that you're not just a great candidate in general, but the perfect fit for their specific role.

Final Tips:

- Keep your descriptions concise but impactful. Aim for 4-6 bullet points per job.

- Avoid repeating information. If you’ve held similar roles, focus on different aspects of your achievements or skills in each position.

- Proofread carefully to ensure accuracy and professionalism.

Effectively presenting your work experience can set you apart from other candidates. By focusing on achievements and tailoring your resume to the Collections Representative role, you demonstrate your value and readiness for the challenges of the position.

Elevating Your Collections Representative Resume with Education and Certifications

The Education section of your Collections Representative resume is more than just a list of schools attended; it's an opportunity to showcase your foundational knowledge and ongoing commitment to professional development. Here's how to effectively include your education and any relevant certifications:

Education: The Foundation of Your Expertise

Start with the highest degree you’ve earned, listing it in reverse chronological order. Include the name of the degree, the institution, and the graduation date. For those in the collections field, degrees in finance, accounting, business administration, or related fields are particularly relevant.

Example Education Section:

Bachelor of Science in Business Administration

University of Southern California

Los Angeles, CA | Graduated May 2022

- Specialization in Financial Management

- Dean’s List 2020-2022

If you’re still pursuing your degree, include your expected graduation date and current GPA if it’s above 3.0. This shows your commitment to furthering your education and your field's relevance.

Highlighting Certifications: A Mark of Professional Excellence

Certifications can significantly bolster your resume, especially in specialized areas like collections and finance. They demonstrate your dedication to your career and your initiative in acquiring additional skills. List any relevant certifications, the issuing organization, and the date of achievement.

Example Certifications Section:

Certified Receivables Professional (CRP)

Receivables Management Association International

Obtained April 2021

Fair Debt Collection Practices Act (FDCPA) Compliance Certification

American Collectors Association

Obtained July 2020

Tailoring Your Education and Certifications to the Role

While listing your education and certifications, consider what’s most relevant to the Collections Representative position. Highlight coursework, projects, or certifications that align closely with the job’s requirements. This might include subjects related to finance, negotiation, customer service, or specific laws and regulations affecting the collections industry.

Additional Tips:

- Ongoing Education: If you're engaged in any continuous learning activities, such as online courses or professional workshops, consider including these as well. They demonstrate a proactive approach to your professional development.

- Professional Associations: Membership in professional organizations can also be included in this section, particularly if you’ve held any leadership roles.

- Relevance is Key: Always prioritize the most relevant educational achievements and certifications for the Collections Representative role.

By thoughtfully including your education and certifications, you convey a strong foundation of knowledge and a commitment to excellence in your field. This section is an integral part of your resume, reinforcing your qualifications and setting you apart as a well-rounded candidate.

Highlighting Essential Skills for Collections Representatives

In the competitive field of collections, your skills section is a concise showcase of the abilities that make you a standout candidate. For Collections Representatives, a balanced mix of technical and soft skills is crucial to navigating the challenges of the role effectively. Here's how to highlight your skills to catch a hiring manager's eye:

Technical Skills: Your Professional Toolkit

Focus on the specific technical skills that demonstrate your ability to perform collections tasks efficiently. This might include:

- Debt Recovery Techniques: Understanding of various strategies to approach and negotiate debt settlements.

- Financial Analysis: Ability to assess financial situations and create suitable payment plans.

- Regulatory Knowledge: Familiarity with laws and regulations governing debt collection, such as the Fair Debt Collection Practices Act (FDCPA).

- Software Proficiency: Experience with collections software, CRMs, and other relevant tools that improve efficiency and customer interaction.

Example Technical Skills Section:

Soft Skills: The Art of Communication and Negotiation

Equally important are the soft skills that enable you to work well with others and handle sensitive situations tactfully. For a Collections Representative, key soft skills include:

- Communication Skills: Your ability to clearly and effectively communicate with debtors, understand their concerns, and explain their options.

- Negotiation Skills: The art of finding mutually beneficial solutions that satisfy both the creditor’s requirements and the debtor’s capabilities.

- Empathy and Customer Service: Understanding and sympathizing with debtors' situations can lead to more successful collections and preserve customer relationships.

- Problem-Solving: The ability to think on your feet and come up with creative solutions to challenging situations.

Example Soft Skills Section:

Tailoring Your Skills to the Job Description

When crafting your skills section, always refer back to the job description. Identify the skills specifically mentioned by the employer and make sure they are prominently featured in your resume. This not only shows that you're a perfect match for the role but also helps your resume pass through Applicant Tracking Systems (ATS) that screen for relevant keywords.

Additional Tips:

- Be Specific: Rather than vague claims of being a "good communicator," provide specific examples of how you use your communication skills to achieve results.

- Prioritize: While it's tempting to list as many skills as possible, prioritize those most relevant to a Collections Representative role and most impressive to potential employers.

- Proof of Skills: Consider how you can demonstrate these skills in other sections of your resume, such as in your work experience or achievements.

By effectively showcasing your technical and soft skills, you paint a comprehensive picture of what you bring to the table as a Collections Representative. This section is your chance to convince potential employers that you possess the unique blend of skills necessary to excel in this role.

Enhancing Your Collections Representative Resume with Additional Sections

To set your Collections Representative resume apart from the competition, consider adding sections that highlight your unique experiences, achievements, or skills. These additional sections can provide a fuller picture of your capabilities and interests, showing potential employers that you're a well-rounded candidate with diverse strengths. Here's how to make the most of these additional sections:

Certifications and Licenses

If you have any professional certifications or licenses relevant to collections or finance, creating a separate section for these can immediately catch an employer's eye. Certifications demonstrate a commitment to your profession and an eagerness to stay updated with industry standards.

Example Certifications:

- Certified Receivables Professional (CRP)

- Certified Credit and Collections Manager (CCCM)

Professional Associations

Membership in professional organizations not only expands your network but also shows your active participation in the industry. List any associations you're a part of, especially if you've taken on leadership roles or contributed to initiatives.

Example Professional Associations:

- Member, Receivables Management Association International (RMAI)

- Member, National Association of Credit Management (NACM)

Volunteer Experience

Volunteer work can illustrate your commitment to community service, teamwork, and leadership abilities. If you have volunteer experience, especially if it's related to finance or collections, include it to showcase your personal values and interpersonal skills.

Example Volunteer Experience:

- Financial Counselor, Debt Advice Charity, Los Angeles, CA

Helped over 50 individuals understand and manage their debt, improving their financial literacy and confidence.

Languages

Being bilingual or multilingual can be a significant asset, especially in diverse communities or global companies. If you speak additional languages, specify your level of proficiency (basic, conversational, fluent, or native).

Example Languages:

- Spanish: Fluent

- French: Conversational

Personal Projects or Interests

While not always directly related to your job, personal projects or interests can reflect your passion, creativity, and dedication. If you have any projects or hobbies that showcase skills relevant to collections or finance, consider adding them.

Example Personal Projects:

- Developed a personal finance blog focusing on debt management and financial planning, attracting over 10k monthly visitors.

Tailoring Additional Sections to the Job

While these sections can enhance your resume, always tailor them to the role you're applying for. Highlight aspects that demonstrate skills or experiences particularly relevant to a Collections Representative position.

Final Tips:

- Keep it relevant and professional. Ensure that everything you include adds value to your application.

- Use these sections to tell a story. They should complement the rest of your resume and provide insight into your character and work ethic.

- Be prepared to discuss any items you list during an interview. Make sure you can articulate how these experiences have shaped you professionally.

By thoughtfully including additional sections in your Collections Representative resume, you can present yourself as a comprehensive candidate with diverse talents and interests. This not only makes your resume more engaging but also demonstrates your multifaceted value to potential employers.

Perfecting Your Collections Representative Cover Letter

A well-crafted cover letter can significantly enhance your application for a Collections Representative position. It offers a personal touch to your application and provides an opportunity to elaborate on your resume's details. Here's how to write a cover letter that complements your resume and makes you stand out:

Start With a Strong Introduction

Begin with a compelling introduction that grabs the reader’s attention. Mention the position you’re applying for and briefly introduce yourself, highlighting your enthusiasm for the role and the company.

Example Introduction:

I am writing to express my interest in the Collections Representative position at [Company Name] as advertised on [Where You Found the Job Posting]. With a solid background in finance and a proven track record in debt collection, I am excited about the opportunity to contribute to your team’s success.

Highlight Your Relevant Experience and Achievements

Use the next one or two paragraphs to detail your relevant experience and key achievements. Connect your past successes to how you can solve the company's current needs. Use specific examples and quantify your achievements to make a stronger impact.

Example Body Paragraph:

In my previous role at [Previous Company], I managed a portfolio of over 500 accounts and succeeded in reducing delinquency rates by 25% within a year through strategic negotiations and personalized payment plans. My approach always balances firmness with empathy, ensuring that while outstanding debts are recovered, customer relationships are maintained and even strengthened.

Demonstrate Your Knowledge of the Company and Its Needs

Show that you’ve done your homework by mentioning something specific about the company or industry and how you can contribute to addressing those needs or challenges. This shows your interest in the role and your proactive attitude.

Example Company Knowledge Paragraph:

Conclude With a Call to Action

End your cover letter on a positive note by thanking the reader for their time and consideration. Include a call to action, expressing your desire to discuss your application further in an interview.

Example Conclusion:

Sincerely,

[Your Name]

Final Tips:

- Customize your cover letter for each application. Avoid using a generic template without any personalization.

- Keep it concise. Your cover letter should not exceed one page.

- Proofread carefully to ensure there are no typos or grammatical errors.

A compelling cover letter for a Collections Representative position not only showcases your qualifications and enthusiasm for the role but also demonstrates your ability to communicate effectively. By following these guidelines, you can create a memorable cover letter that captures the hiring manager's attention and complements your resume.

Further Insights and Final Touches for Your Collections Representative Resume

Embrace the Power of Personal Branding

In a competitive job market, personal branding can be the key to standing out. Consider your resume and cover letter as parts of your personal brand. They should reflect not only your qualifications and achievements but also your professional persona and how you differentiate yourself from other candidates. Consistency in tone, style, and messaging across all your application materials can reinforce your personal brand.

Stay Updated and Relevant

The collections industry, like many others, evolves with new technologies and regulations. Stay informed about industry trends, and be ready to discuss recent changes and how they affect your work during interviews. Updating your resume to reflect ongoing education or training can also demonstrate your commitment to staying relevant.

Networking and Professional Development

Don’t underestimate the power of networking. Engaging with industry professionals through events, online forums, or professional associations can provide insights into what top employers are looking for. It can also lead to referral opportunities, which are invaluable in the job search process.

Tailoring Is Key

A tailored resume and cover letter can significantly increase your chances of landing an interview. Take the time to research the company and the specific role you’re applying for, and adjust your application materials accordingly. Highlight the experiences and skills that are most relevant to the job description.

Following Up

After submitting your application, a polite follow-up email can show your continued interest in the position and can sometimes bring your application back to the top of the pile. However, be respectful of the hiring manager’s time and avoid following up more than once.

Preparing for the Interview

If your application catches an employer's eye, the next step will be the interview. Rehearse answers to common interview questions, but also prepare examples that showcase your achievements and how you’ve overcome challenges. Remember, the interview is also your opportunity to learn more about the company and the team to ensure it’s the right fit for you.

Key Takeaway: The Path to Success

Crafting a standout resume and cover letter is the first step in landing your ideal Collections Representative role. By highlighting your achievements, tailoring your application, and presenting a cohesive personal brand, you can capture the attention of potential employers. Remember, the goal is not just to show that you can do the job, but that you can bring unique value to their team.

With these strategies in mind, you’re well on your way to securing your next position in the field of collections. Keep learning, stay engaged with your professional community, and never underestimate the impact of a well-crafted resume.

Frequently Asked Questions About Writing a Collections Representative Resume

How Do I Make My Collections Representative Resume Stand Out?

A: Tailor your resume specifically to the collections role, highlighting your relevant experience and achievements. Use keywords from the job description, quantify your accomplishments, and include a mix of technical and soft skills. A clean, professional format and a compelling summary or objective can also make your resume stand out.

Can I Include Part-Time Work or Internships?

A: Absolutely. Any experience that demonstrates your skills and work ethic, including part-time jobs, internships, or volunteer work, can be valuable on your resume. Be sure to highlight how these experiences have prepared you for a full-time role as a Collections Representative.

How Should I Address Employment Gaps in My Resume?

A: Be honest about employment gaps, but also use your cover letter or interview to explain them positively. For example, if you took time off for personal development or to pursue education, make sure to highlight what you learned during that time and how it applies to your career in collections.

Should I Include References on My Resume?

A: It's generally not necessary to include references on your resume unless specifically requested by the employer. Instead, have a list of references ready to provide upon request. This allows you more space on your resume to focus on your skills and achievements.

How Long Should My Resume Be?

A: For most professionals, a one-page resume is ideal, especially if you have less than 10 years of experience. If you have a longer career history or significant achievements that require more space, a two-page resume is acceptable, but be sure to prioritize the most relevant information.

Is a Cover Letter Really Necessary?

A: Yes, a cover letter is often your first opportunity to communicate directly with a potential employer. It allows you to explain your interest in the role, highlight key achievements, and demonstrate how your skills align with the company's needs. Always include a customized cover letter with your application, unless the job posting explicitly states not to.

How Often Should I Update My Resume?

A: It's a good practice to review and update your resume at least once a year, even if you're not actively job searching. This helps ensure your resume is ready when new opportunities arise and reflects your most current skills and achievements.

By addressing these common questions, you can refine your Collections Representative resume and cover letter, making them more effective tools in your job search. Remember, the goal is to present a compelling, complete picture of your professional qualifications tailored to the specific needs of the employer.

Recommended Reading