In the bustling world of Accounting & Finance, standing out from the crowd is paramount, especially for roles as critical as Accounts Receivable. These positions not only require a keen eye for detail and a solid understanding of financial processes but also demand a resume that showcases your unique skills and experiences effectively. This guide is your comprehensive roadmap to crafting a resume that not only captures attention but also highlights your prowess in managing financial accounts, ensuring timely payments, and contributing to the financial health of your organization. Whether you're a seasoned professional or stepping into this role for the first time, our insights will help you construct a resume that speaks volumes about your capabilities and sets you on the path to success in the Accounting & Finance sector.

Accounts Receivable Resume: A Model of Excellence

Camila Torres

233 Eastview Road, Tampa, FL 33602

(555) 987-6543 | camila.torres@example.com

LinkedIn: linkedin.com/in/camilatorres-ar

Professional Summary

Dedicated and results-oriented Accounts Receivable Specialist with over 5 years of experience in fast-paced finance departments. Proven track record in reducing outstanding account balances, improving cash flow, and streamlining billing processes. Adept at maintaining accurate financial records and reports, performing account reconciliations, and ensuring compliance with company policies. Strong interpersonal and communication skills, proficient in building relationships with clients to resolve payment issues amicably.

Professional Experience

Senior Accounts Receivable Specialist

Dynamic Tech Solutions, Miami, FL

June 2019 – Present

- Managed a portfolio of over 300 accounts, reducing the average days sales outstanding (DSO) from 45 to 30 days within the first year.

- Implemented an automated billing system that reduced manual data entry errors by 40% and improved overall billing efficiency.

- Collaborated with the sales and customer service departments to resolve disputed charges, resulting in a 25% decrease in outstanding receivables.

- Developed monthly financial reports that highlighted aging accounts receivables, which enabled the management team to make informed decisions.

Accounts Receivable Analyst

Greenwood Industries, Orlando, FL

March 2017 – May 2019

- Processed daily invoices and payments, ensuring accuracy and compliance with financial policies.

- Assisted in the transition to a new accounting software, leading training sessions for the Accounts Receivable team.

- Conducted regular audits of accounts receivable records, identifying discrepancies and implementing corrective actions.

- Maintained up-to-date customer contact information to expedite the collection process.

Education

Bachelor of Science in Accounting

University of Florida, Gainesville, FL

Graduated: May 2016

Skills

- Expertise in accounting software (QuickBooks, Oracle NetSuite)

- Strong analytical and problem-solving abilities

- Excellent communication and negotiation skills

- Detail-oriented with a high degree of accuracy

- Proficient in Microsoft Office Suite (Excel, Word)

Certifications

Certified Accounts Receivable Professional (CARP)

Institute of Finance & Management (IOFM), 2018

Crafting the Perfect Structure for Your Accounts Receivable Resume

A well-structured resume is your first step toward landing an Accounts Receivable position in the competitive field of Accounting & Finance. Your resume should be a reflection of your professionalism, precision, and ability to organize information effectively. Here’s how to structure your resume to showcase your skills and experience in the best light:

Prioritize Clarity and Ease of Reading

Your resume should be easy to read at a glance, with clear headings, bullet points, and consistent formatting. Use a professional font like Arial or Calibri, and keep the font size between 10 and 12 points. Margins should be standard (1” on all sides), ensuring the document is neatly organized and visually appealing.

The Optimal Resume Layout

- Header: Start with your name, contact information, and professional social media profiles, like LinkedIn. This should be prominently placed at the top of your resume.

- Professional Summary or Objective: Offer a brief overview of your skills and career goals. Tailor this section to highlight qualities that are most relevant to an Accounts Receivable role, such as precision, analytical skills, and experience with financial software.

- Work Experience: List your professional experience in reverse chronological order. Include your job title, the company’s name, location, and the dates of employment. Use bullet points to describe your responsibilities and achievements in each role, focusing on those that demonstrate your proficiency in managing receivables, improving cash flow, and enhancing financial processes.

- Education: Mention your highest level of education, including the degree obtained, the name of the institution, and the graduation date. If you have completed relevant coursework or certifications, such as a Certified Accounts Receivable Professional (CARP), include these details here.

- Skills: Highlight specific skills related to Accounts Receivable, including proficiency in accounting software, data analysis, and customer service. This section should be tailored to match the requirements mentioned in the job listing.

- Additional Sections: Depending on your background, you might add sections for certifications, professional memberships, volunteer work, or languages. Any additional information that demonstrates your qualifications for an Accounts Receivable role can be included here.

Customize Your Resume for the Job

Always tailor your resume to the job you’re applying for. Use keywords from the job description, and focus on experiences and skills that match the employer’s requirements. This customization shows that you’ve taken the time to understand what they’re looking for and that your professional background aligns with their needs.

Remember, your resume is more than a list of your work history and skills; it’s a tool to tell your professional story in a way that highlights your suitability for the specific Accounts Receivable role you’re targeting. Taking the time to structure it effectively can make a significant difference in catching the attention of hiring managers in the Accounting & Finance sector.

Final Tips: Proofreading and Feedback

Before submitting your resume, proofread it thoroughly for any spelling or grammatical errors. Errors can detract from your professionalism and attention to detail. Additionally, consider getting feedback from mentors or colleagues in the industry. External perspectives can offer valuable insights on how to improve your resume further.

By following these guidelines, you’ll create a resume that not only looks professional but also clearly articulates your qualifications and readiness for an Accounts Receivable role. Remember, a well-structured resume is your ticket to securing interviews and moving closer to your career goals in the Accounting & Finance industry.

Crafting an Impactful Resume Summary or Objective for Accounts Receivable Professionals

In the competitive landscape of Accounting & Finance, your resume's summary or objective is your opportunity to make a memorable first impression. This section, sitting at the top of your resume, succinctly highlights your key achievements, skills, and career aspirations. For Accounts Receivable professionals, it's crucial to tailor this section to reflect your expertise in managing receivables, improving financial processes, and contributing to the financial health of your organization.

The Difference Between a Summary and an Objective

- Resume Summary: Ideal for experienced professionals, a resume summary offers a snapshot of your career highlights and key skills. It emphasizes your track record and how it aligns with the job you're applying for.

- Resume Objective: Suited for entry-level candidates or those transitioning to a new career, a resume objective focuses on your career goals and how they match the opportunities the position provides. It's about showing your potential to grow into the role.

Writing an Accounts Receivable Resume Summary

An effective resume summary for an Accounts Receivable

"Detail-oriented Accounts Receivable Specialist with over 5 years of experience in fast-paced financial environments. Demonstrated ability to reduce outstanding balances, streamline billing processes, and improve cash flow. Skilled in financial reporting, account reconciliation, and enhancing customer relationships to facilitate timely payments. Seeking to leverage my expertise to contribute to the financial efficiency of [Company Name]."

This summary does an excellent job of highlighting experience, key skills, and a track record of achievements, making the candidate appealing for an Accounts Receivable role.

Crafting an Accounts Receivable Resume Objective

An objective for someone entering the Accounts Receivable field:

"Recent finance graduate with strong analytical skills and a solid foundation in accounting principles, eager to apply my knowledge in Accounts Receivable at [Company Name]. Highly motivated to develop my skills in financial reporting, account reconciliation, and client management in a dynamic accounting team."

This objective clearly communicates the candidate's career goals and willingness to learn and grow in the role, making it attractive to potential employers looking to invest in emerging talent.

Tailoring Your Summary or Objective

Tailor your resume's opening to the job you're applying for by incorporating keywords from the job description and focusing on the specific skills and experiences the employer values. For Accounts Receivable positions, emphasize your proficiency with financial software, your ability to manage and reduce outstanding balances, and your track record of improving financial processes.

Conclusion

Your resume's summary or objective is more than just an introduction; it's a strategic tool to capture the hiring manager's interest and make them want to learn more about you. By carefully crafting this section to highlight your strengths and career aspirations, you can set the tone for the rest of your resume and increase your chances of landing your next Accounts Receivable role in the Accounting & Finance sector.

Highlighting Work Experience on Your Accounts Receivable Resume

Your work experience section is the heart of your resume, especially for a position in Accounts Receivable within the Accounting & Finance sector. It's where you showcase your professional journey and highlight your contributions to previous employers. To make this section impactful, follow these guidelines and incorporate examples that demonstrate your expertise and achievements.

Use Reverse Chronological Order

Start with your most recent position and work backward. This format is favored by hiring managers as it provides a clear view of your career progression.

Focus on Achievements, Not Just Duties

Rather than merely listing your job duties, emphasize your achievements. Use quantifiable metrics where possible to demonstrate how your work contributed to the company's financial health or efficiency.

Example of How to List Work Experience:

Accounts Receivable Specialist

Tech Innovations, Inc.

San Francisco, CA

July 2018 – Present

- Managed and tracked invoices for over 400 clients, significantly reducing the average payment turnaround time by 20 days through the implementation of a new electronic invoicing system.

- Enhanced the monthly financial reporting process, leading to a 30% reduction in discrepancies and a faster closing process.

- Collaborated with the sales and customer service departments to resolve billing disputes, achieving a 90% resolution rate within the first contact.

Tailor Your Experience to the Job Description

Identify the skills and experiences the employer is looking for by analyzing the job description. Tailor your work experience section to reflect these requirements, using keywords and phrases from the listing to improve your resume’s visibility to Applicant Tracking Systems (ATS).

Use Action Words

Begin each bullet point with a strong action verb that conveys your role and contribution. Words like "Managed," "Implemented," "Enhanced," and "Collaborated" are powerful and engaging.

Highlight Your Problem-Solving Skills

Accounts Receivable roles often require troubleshooting and problem-solving, particularly when dealing with overdue accounts or discrepancies. Include examples of how you've successfully navigated challenges or implemented solutions to improve processes.

Problem-Solving in Action:

Accounts Receivable Coordinator

Global Solutions, Ltd.

New York, NY

March 2015 – June 2018

- Spearheaded the development of a comprehensive client communication strategy that reduced late payments by 35%.

- Negotiated with delinquent accounts to secure payment plans, successfully recovering $250,000 in outstanding receivables within six months.

- Implemented a new account reconciliation procedure that increased accuracy and reduced the time spent on monthly closings by 25%.

Keep It Relevant

While it's important to showcase your career achievements, focus on the experiences most relevant to the Accounts Receivable role you're applying for. This might mean omitting or briefly summarizing positions that are less pertinent.

Crafting a work experience section that clearly articulates your value and achievements in past Accounts Receivable roles can set you apart from other candidates. By demonstrating how you've positively impacted your previous employers, you provide potential employers with a compelling reason to consider you for their team.

Showcasing Your Educational Achievements: Crafting the Education Section of Your Accounts Receivable Resume

The education section of your resume is more than a list of degrees; it's an opportunity to demonstrate the foundation of your knowledge and skills in Accounts Receivable and the broader Accounting & Finance sector. Whether you're a recent graduate or a seasoned professional, your educational background plays a crucial role in setting the stage for your expertise. Here's how to effectively highlight your educational achievements:

Start with Your Highest Degree

Lead with your most advanced degree, working in reverse chronological order. This approach immediately draws attention to your highest level of academic achievement, whether it's a bachelor's, master's, or any specialized certifications relevant to the Accounts Receivable field.

Include Essential Details

For each degree or certification, include the following details:

- Name of the Degree: Specify the degree type and your major or concentration if relevant to the job. For instance, "Bachelor of Science in Accounting."

- Institution: Name the college, university, or institution where you earned the degree.

- Location: While not always necessary, you can include the city and state of the institution.

- Graduation Date: Mention the month and year of graduation. If you're currently enrolled, you can say "Expected graduation [month, year]."

Highlight Relevant Coursework and Achievements

If you have coursework or academic achievements that directly relate to Accounts Receivable or demonstrate valuable skills for the role, don't hesitate to include them. This can be particularly beneficial for recent graduates with less professional experience.

Example of Highlighting Relevant Coursework:

Bachelor of Science in Accounting

University of Central Florida

Orlando, FL

Graduated: May 2023

- Relevant Coursework:

- Financial Accounting,

- Accounts Receivable Management,

- Business Communications

Certifications and Continuing Education

In addition to traditional degrees, certifications and ongoing professional development courses can significantly enhance your resume. They demonstrate your commitment to staying current in your field and can give you an edge in specialized areas of Accounts Receivable and finance. Be sure to include any certifications that are in progress or completed, specifying the certifying body and the date of certification.

Example of Including Certifications:

Certified Accounts Receivable Professional (CARP)

Institute of Finance & Management (IOFM), 2022

Tailor the Education Section to the Job Description

If the job listing emphasizes certain educational requirements or preferences, make sure your education section addresses these. Tailoring your resume to reflect the employer's needs can further underscore your suitability for the position.

Keep It Concise

While your educational background is important, remember to keep this section concise. Focus on the information that is most relevant and impactful for the Accounts Receivable role you're applying for. This allows hiring managers to quickly assess your qualifications and move on to the details of your professional experience and skills.

Crafting a well-organized and informative education section is an integral part of building a compelling Accounts Receivable resume. By strategically presenting your academic credentials, you underscore the foundation of your expertise in the field and position yourself as a knowledgeable and qualified candidate.

Highlighting Essential Skills for an Accounts Receivable Resume

In the Accounting & Finance sector, especially in an Accounts Receivable role, showcasing a blend of technical and soft skills on your resume is crucial. This section demonstrates to employers that you have the comprehensive skill set needed to manage financial accounts efficiently, ensure accurate billing, and maintain positive client relationships. Here's how to highlight your skills effectively.

Technical Skills

Accounting Software Proficiency: Mention specific accounting software you’re proficient in, such as QuickBooks, Oracle NetSuite, or SAP. Highlighting your ability to navigate and utilize these tools efficiently demonstrates your readiness to manage and reconcile accounts receivable records effectively.

Financial Reporting and Analysis: Showcase your skills in generating financial reports, analyzing accounts receivable data, and utilizing this analysis to inform business decisions. This ability is key to ensuring a company's financial health and stability.

Billing and Invoicing: Highlight your experience with creating, sending, and managing invoices. This includes understanding various billing formats and systems, which is critical for ensuring timely payments and maintaining cash flow.

Soft Skills

Communication Skills: Your ability to communicate clearly and effectively with clients, team members, and other departments is vital. Highlight examples of successfully managing client inquiries, negotiating payment plans, or collaborating with sales and customer service teams to resolve billing issues.

Problem-Solving Skills: Showcase instances where you've successfully identified and resolved discrepancies in accounts, improved billing processes, or developed strategies to reduce outstanding account balances.

Attention to Detail: Emphasize your meticulousness in managing financial records, ensuring accuracy in billing and account reconciliations. This skill is crucial for maintaining the integrity of financial data and preventing errors.

How to Present Your Skills

- Use Bullet Points: List your skills in bullet format to make them easy to scan and digest. This format also allows you to keep your resume tidy and organized.

- Incorporate Keywords from the Job Description: Tailor your skills section to match the job listing by including keywords and phrases used in the description. This not only shows that your skills align with what the employer is looking for but also helps your resume get past Applicant Tracking Systems (ATS).

- Provide Context: Whenever possible, provide examples or brief descriptions of how you've applied these skills in a professional setting. This can be particularly effective for soft skills, where demonstrating how you've used these skills can be more impactful than simply listing them.

Example Skills Section for an Accounts Receivable Resume

- Proficient in QuickBooks, Oracle NetSuite, and SAP for accounts receivable management.

- Skilled in generating detailed financial reports and performing accounts analysis to drive decision-making.

- Experienced in handling billing and invoicing processes, ensuring accuracy and timeliness.

- Excellent communication skills, with a track record of resolving client inquiries and disputes effectively.

- Strong problem-solving abilities, demonstrated through successful account reconciliation projects and process improvements.

- Exceptional attention to detail in managing financial records and conducting audits to ensure accuracy.

By strategically showcasing your technical and soft skills, you make a compelling case for your candidacy. Remember, your skills section is an opportunity to highlight how your unique abilities make you the perfect fit for an Accounts Receivable role within the Accounting & Finance sector.

Incorporating Additional Sections to Elevate Your Accounts Receivable Resume

Adding extra sections to your Accounts Receivable resume can significantly enhance its impact, particularly in the competitive Accounting & Finance job market. These sections allow you to showcase your broader competencies, achievements, and personal initiatives that align with the role's requirements. Here's how to effectively use additional sections to distinguish yourself.

Certifications and Licenses

In the Accounting & Finance sector, certifications can bolster your credibility and demonstrate your specialized knowledge. For Accounts Receivable positions, consider including certifications such as:

- Certified Accounts Receivable Professional (CARP)

- Certified Public Accountant (CPA), if applicable

- Any software-specific certifications, like QuickBooks Certified User or Oracle NetSuite Certifications

Listing these certifications shows a commitment to your professional development and assures employers of your expertise and competency in critical areas.

Professional Memberships

Being part of professional organizations can be a testament to your commitment to your career and continuous learning. Include memberships in relevant associations, such as:

- The American Institute of Certified Public Accountants (AICPA)

- The Institute of Financial Operations and Leadership (IFOL)

- Regional or local accounting and finance associations

These memberships can also indicate your network's breadth and depth, potentially beneficial for business connections and staying informed on industry trends.

Volunteer Experience

Volunteer work, especially if it's related to finance or community service, can reflect your personal values and soft skills. Highlight volunteer experiences that demonstrate leadership, teamwork, or financial acumen. This section can humanize your resume, showing you're not just proficient in your field but also engaged and proactive in your community.

Projects

If you've worked on relevant projects, either independently or as part of your job, that demonstrate your skills in accounts receivable or financial management, include them. This could be anything from implementing a new invoicing system to developing a strategy to reduce outstanding debts. Detailing these projects can showcase your initiative, problem-solving skills, and ability to achieve tangible results.

Languages

Fluency in additional languages can be a valuable asset in today’s globalized business environment. If you speak languages beyond English, especially if they're relevant to the company's market or clients, list them. This skill can position you as a candidate capable of communicating with a broader range of clients or contributing to international operations.

Interests

While not always necessary, a brief section on relevant professional interests can add depth to your resume. If your interests align with industry trends or the company's focus areas, mentioning them can spark conversation in an interview or show that you're a well-rounded candidate.

How to Incorporate Additional Sections

- Keep It Relevant: Only include information that can enhance your application or show skills pertinent to the Accounts Receivable role.

- Be Concise: These sections should complement your resume, not overshadow the essential details of your experience and skills. Keep descriptions brief and impactful.

- Tailor to the Job Description: If the job listing mentions specific qualifications or interests, and you have them, make sure they're included in your resume.

By thoughtfully incorporating additional sections into your Accounts Receivable resume, you provide a fuller picture of your capabilities, interests, and professional dedication. This approach can make your resume stand out, showcasing you as a well-rounded and versatile candidate ideal for the role.

Crafting a Compelling Cover Letter for Your Accounts Receivable Application

A well-written cover letter is your chance to personally connect with a potential employer and elaborate on your resume's highlights. For an Accounts Receivable position in the Accounting & Finance sector, your cover letter should underscore your proficiency in managing financial records, ensuring timely payments, and your dedication to financial accuracy. Here’s how to craft a cover letter that complements your resume and persuades employers to give you closer consideration.

Start With a Strong Introduction

Begin your cover letter by addressing the hiring manager by name whenever possible. Your opening paragraph should grab their attention, introducing who you are and expressing your enthusiasm for the opportunity.

Introduction Example:

Dear Ms. Johnson,

I am writing to express my interest in the Accounts Receivable Specialist position at [Company Name], as advertised on [where you found the job posting]. With a solid foundation in accounting principles and a proven track record of reducing outstanding account balances, I am excited about the opportunity to contribute to your team’s success.

Highlight Your Relevant Experience

Use the next section of your cover letter to delve into your professional background. Pick one or two key achievements from your resume that are particularly relevant to the job description and expand on them. This is your chance to show how your experiences align with the job duties and the company’s goals.

Experience Highlight Example:

At my previous position with [Previous Company], I spearheaded a project to overhaul the invoicing process, which resulted in a 30% reduction in days sales outstanding (DSO). This initiative not only improved our cash flow but also enhanced customer satisfaction by providing clearer, more timely billing communications.

Demonstrate Your Skills and Fit

Beyond just recounting your past work achievements, use your cover letter to illustrate your personal qualities and how they make you a great fit for the Accounts Receivable role and the company culture. Emphasize your attention to detail, your ability to work under pressure, and your excellent communication skills.

Skills and Fit Example:

I am particularly drawn to [Company Name] because of your commitment to innovation and excellence in the finance sector. I am eager to bring my skills in financial analysis, problem-solving, and my proactive approach to managing accounts to your dynamic team, contributing to your continued success and growth.

Conclude With a Call to Action

End your cover letter on a proactive note by thanking the hiring manager for considering your application and expressing your desire for a personal interview. A call to action can show your eagerness to move forward in the hiring process.

Conclusion Example:

Thank you for considering my application. I am looking forward to the opportunity to discuss in more detail how I can contribute to the Accounts Receivable team at [Company Name]. I am available at your convenience for an interview and can be reached at [Your Phone Number] or [Your Email Address].

Sincerely,

[Your Name]

Personalize and Proofread

Tailor your cover letter for each application, reflecting your knowledge of the company and how your specific skills can address their needs. Before sending, proofread carefully to ensure there are no errors, as these can undermine your credibility.

Your cover letter is an invaluable tool to express your interest, share your story, and make a memorable impression on the hiring manager. By following these guidelines, you’ll craft a compelling cover letter that showcases your suitability for the Accounts Receivable role and sets you apart in the Accounting & Finance job market.

Concluding Insights and Next Steps for Accounts Receivable Resume Success

In crafting your Accounts Receivable resume and cover letter for the Accounting & Finance sector, the goal is to present a compelling narrative of your professional journey, skills, and potential contributions to a prospective employer. From structuring your resume to highlight your most relevant experiences and achievements, to articulating your qualifications in a cover letter, each element of your application should work harmoniously to showcase your candidacy.

Key Takeaways for Your Accounts Receivable Resume:

- Customization Is Key: Tailor your resume and cover letter for each job application, ensuring that you highlight the skills and experiences most relevant to the job description.

- Quantify Your Achievements: Whenever possible, use numbers to demonstrate your impact in previous roles, such as reducing outstanding account balances or improving billing efficiency.

- Showcase Your Soft Skills: Accounts Receivable roles require not just technical proficiency but also excellent communication, negotiation, and problem-solving skills. Make sure these are evident in your resume and cover letter.

- Professional Development Matters: Highlight any certifications, continuous education, or professional memberships that underscore your commitment to your professional growth and the field of Accounting & Finance.

- Attention to Detail: Proofread your application materials thoroughly to avoid errors, and ensure your layout and formatting are clean and professional.

Final Thoughts:

The process of job searching can be challenging, but with a well-crafted resume and cover letter, you're well on your way to securing an Accounts Receivable position that fits your skills and career aspirations. Remember, your resume is your first opportunity to make an impression on a potential employer, so invest the time to make it as strong as possible.

In your cover letter, complement the factual aspects of your resume with more personal insights into your professional ethos, your motivations, and why you're excited about the opportunity. This holistic approach to your application can significantly increase your chances of standing out in a competitive job market.

Lastly, consider your job application as part of a broader career strategy. Continue to seek opportunities for professional development, expand your professional network, and stay abreast of industry trends. These efforts will not only enhance your resume over time but also ensure you remain a competitive candidate in the dynamic field of Accounting & Finance.

By following these guidelines and maintaining a proactive approach to your career development, you'll be well-equipped to navigate the job market and achieve your professional goals in the Accounts Receivable domain.

FAQs: Navigating Accounts Receivable Resume and Cover Letter Writing

Creating an effective resume and cover letter for an Accounts Receivable position in the Accounting & Finance sector can raise questions, especially for those new to the field or seeking advancement. Below are some frequently asked questions and their answers to guide you through crafting these essential documents.

How long should my Accounts Receivable resume be?

Aim for a one-page resume, especially if you have less than 10 years of experience. This length forces you to focus on your most relevant and impressive achievements. However, seasoned professionals with extensive relevant experience can consider a two-page resume if necessary to include all pertinent information.

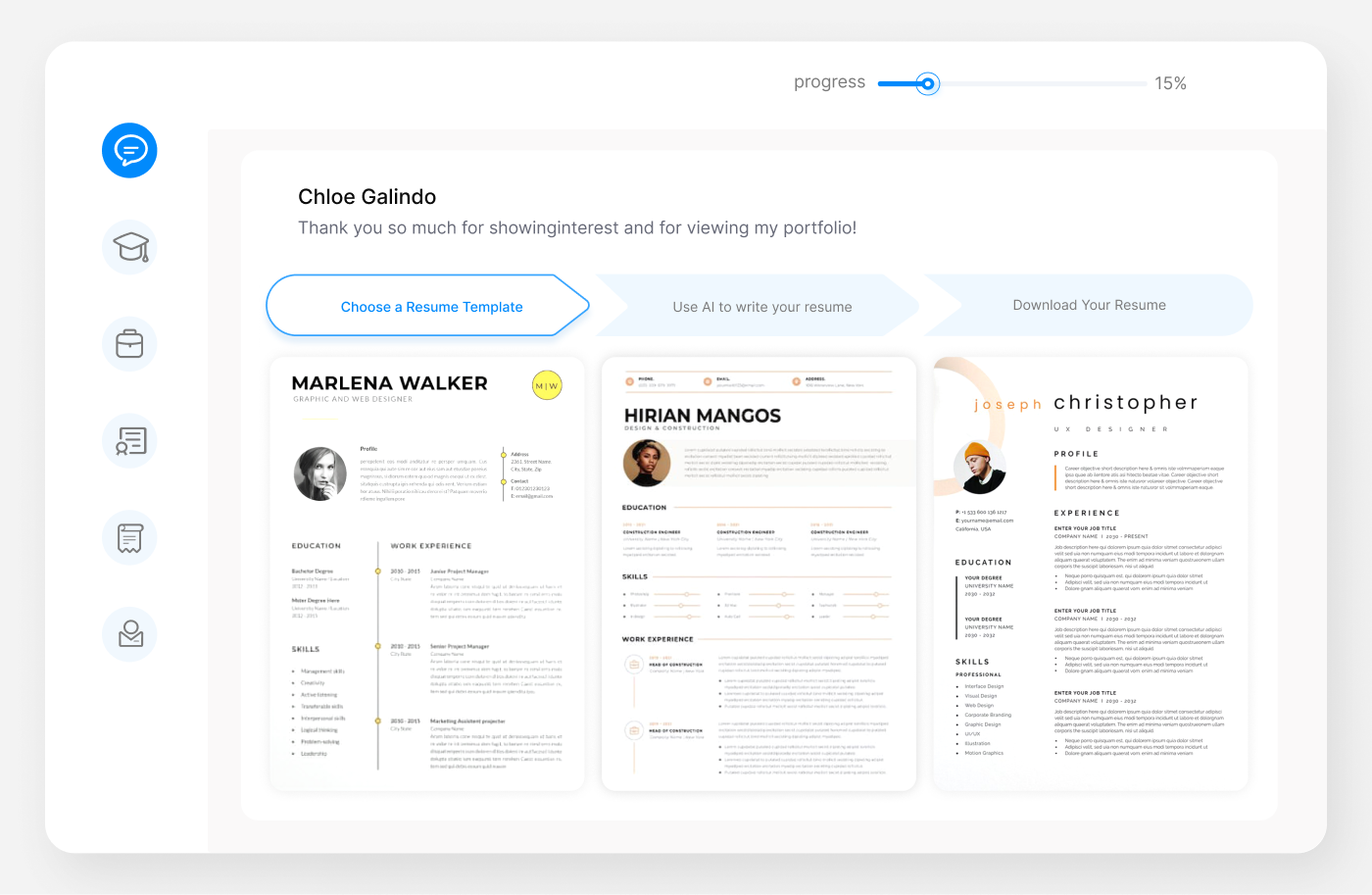

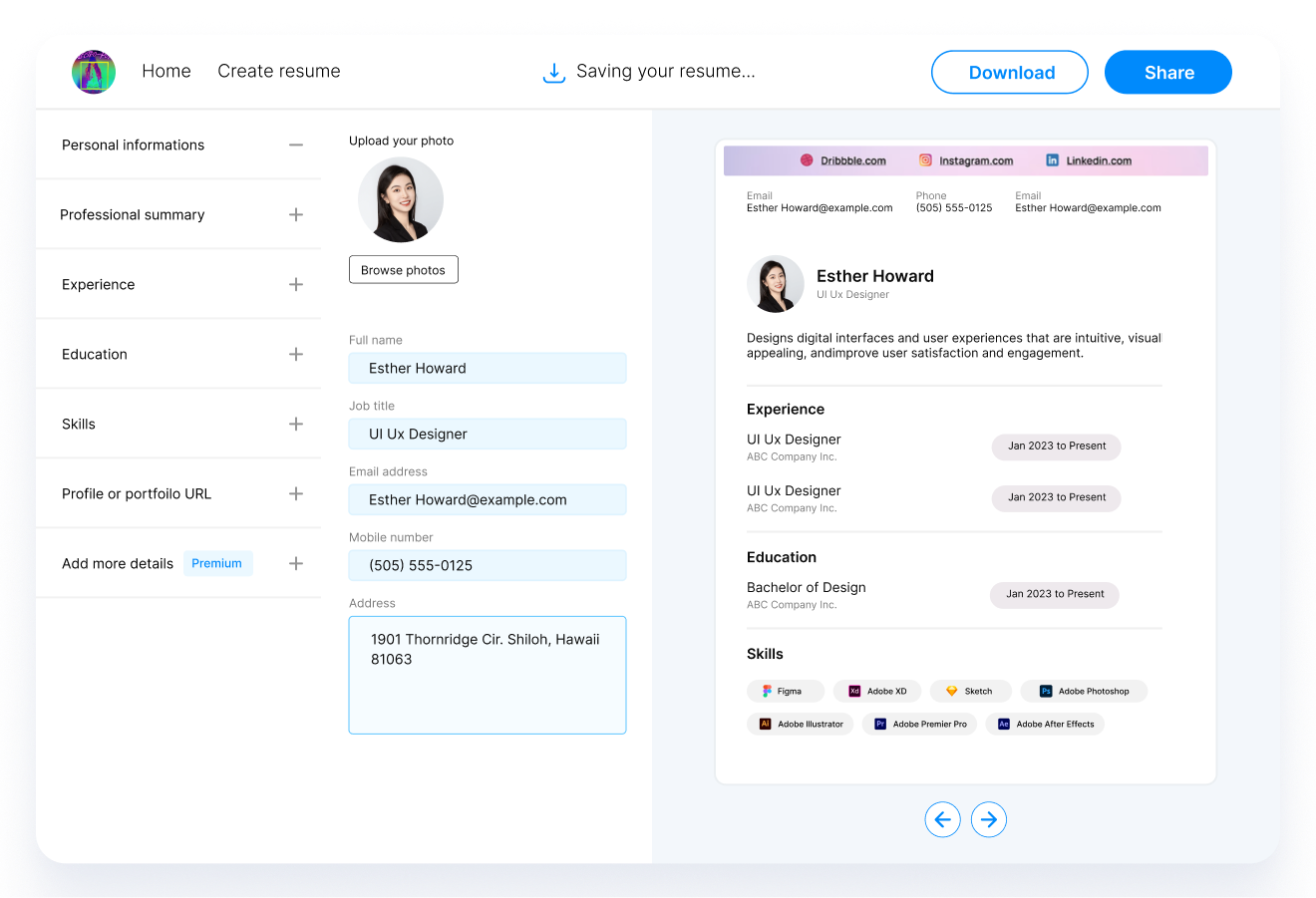

Can I use a template for my resume and cover letter?

Templates can be a helpful starting point, but customize them to fit your information and to stand out. Avoid overly ornate designs that can distract from your content. For Accounts Receivable positions, clarity and professionalism are key.

How do I make my resume stand out?

- Quantify your achievements: Use numbers to demonstrate your impact in previous roles, such as reducing outstanding account balances or increasing the efficiency of billing processes.

- Tailor your resume: Customize your resume for each job application, highlighting the experiences and skills most relevant to the specific Accounts Receivable position.

- Use keywords: Incorporate industry-specific terms and phrases from the job listing to get past ATS (Applicant Tracking Systems) and catch the hiring manager’s eye.

Should I include a cover letter even if it’s not required?

Yes, always include a cover letter unless explicitly stated not to. A cover letter allows you to introduce yourself, explain your interest in the role and the company, and provide context for your resume. It's an additional opportunity to persuade the employer that you are the right candidate.

How can I address employment gaps in my resume?

Be honest and prepare to discuss the gaps during your interview. Use your cover letter to briefly explain any significant gaps, focusing on constructive activities during those periods, such as further education, freelance projects, or volunteering. Highlight how these experiences have contributed to your professional growth.

How often should I update my resume and cover letter?

Regular updates are crucial, even when you're not actively job searching. Add new skills, certifications, and accomplishments as they occur. This practice keeps your documents ready for any unexpected opportunities and ensures they reflect your current professional level.

Is it important to customize my resume and cover letter for each application?

Absolutely. Tailoring your resume and cover letter to each position is crucial for demonstrating your interest and how your skills and experiences align with the job requirements. Use information from the job listing to highlight your most relevant qualifications and to address the company’s specific needs and challenges.

By addressing these common questions and following the guidance provided, you'll be well on your way to crafting a compelling resume and cover letter for Accounts Receivable positions. Remember, these documents are your first opportunity to make a strong impression on potential employers, so take the time to ensure they're polished, professional, and personalized.

Recommended Reading