In the dynamic world of finance, the role of a bank manager stands out as pivotal in steering branch success and ensuring customer satisfaction. These professionals are tasked with a multifaceted job that encompasses financial management, customer service, team leadership, and compliance with banking laws. Given the criticality of this position, crafting a resume that effectively showcases your experience, skills, and achievements is vital for capturing the attention of top-tier banks and financial institutions. This guide is your gateway to understanding what it takes to develop a compelling bank manager resume. Whether you're aiming for a promotion within your current institution or seeking new challenges elsewhere, our insights will help you present yourself as the ideal candidate for the job.

Bank Manager Resume Example

Jessica Walters

San Francisco, CA

(415) 555-0132

jessica.walters@example.com

LinkedIn: linkedin.com/in/jessicawalters

Objective

Experienced and results-oriented Bank Manager with over 10 years of proven expertise in financial management, strategic planning, and team leadership. Skilled in driving operational efficiency, enhancing customer satisfaction, and increasing profitability. Seeking to leverage extensive background in finance to contribute to the success of a dynamic banking team.

Professional Experience

Bank of Metropolitan, San Francisco, CA

Bank Manager

June 2015 – Present

- Led a team of 30 bank employees, achieving a 20% increase in customer satisfaction and a 15% increase in overall profitability within the first year.

- Implemented new financial products that resulted in a 25% increase in loan acquisition and a 30% increase in deposit growth.

- Streamlined operational processes, reducing average customer wait time by 40% and significantly improving service efficiency.

- Developed and maintained strong relationships with the local business community, resulting in a 35% increase in business account openings.

First Community Bank, Oakland, CA

Assistant Bank Manager

March 2010 – May 2015

- Assisted in the management of daily operations, contributing to a 10% yearly growth in total assets.

- Played a key role in staff training and development, reducing employee turnover by 25%.

- Coordinated with the marketing department to launch successful promotional campaigns, increasing brand awareness and attracting new customers.

Education

Master of Business Administration (MBA), Finance

University of California, Berkeley, CA

Graduated: May 2010

Bachelor of Science in Business Administration

San Francisco State University, San Francisco, CA

Graduated: May 2008

Skills

- Financial Management

- Strategic Planning

- Team Leadership

- Customer Service Excellence

- Operational Efficiency

- Financial Product Development

- Relationship Building

Certifications

- Certified Bank Manager (CBM)

- Financial Risk Manager (FRM)

Crafting a Resume That Opens Doors: Your Blueprint to Success

Crafting a resume for a bank manager position involves more than just listing your job experiences and education. It's about presenting your achievements, skills, and expertise in a way that speaks directly to the needs and goals of potential employers in the finance sector. Your resume must be structured to highlight your most relevant experiences, achievements, and skills in a clear, concise, and compelling manner. Here's how to do it right:

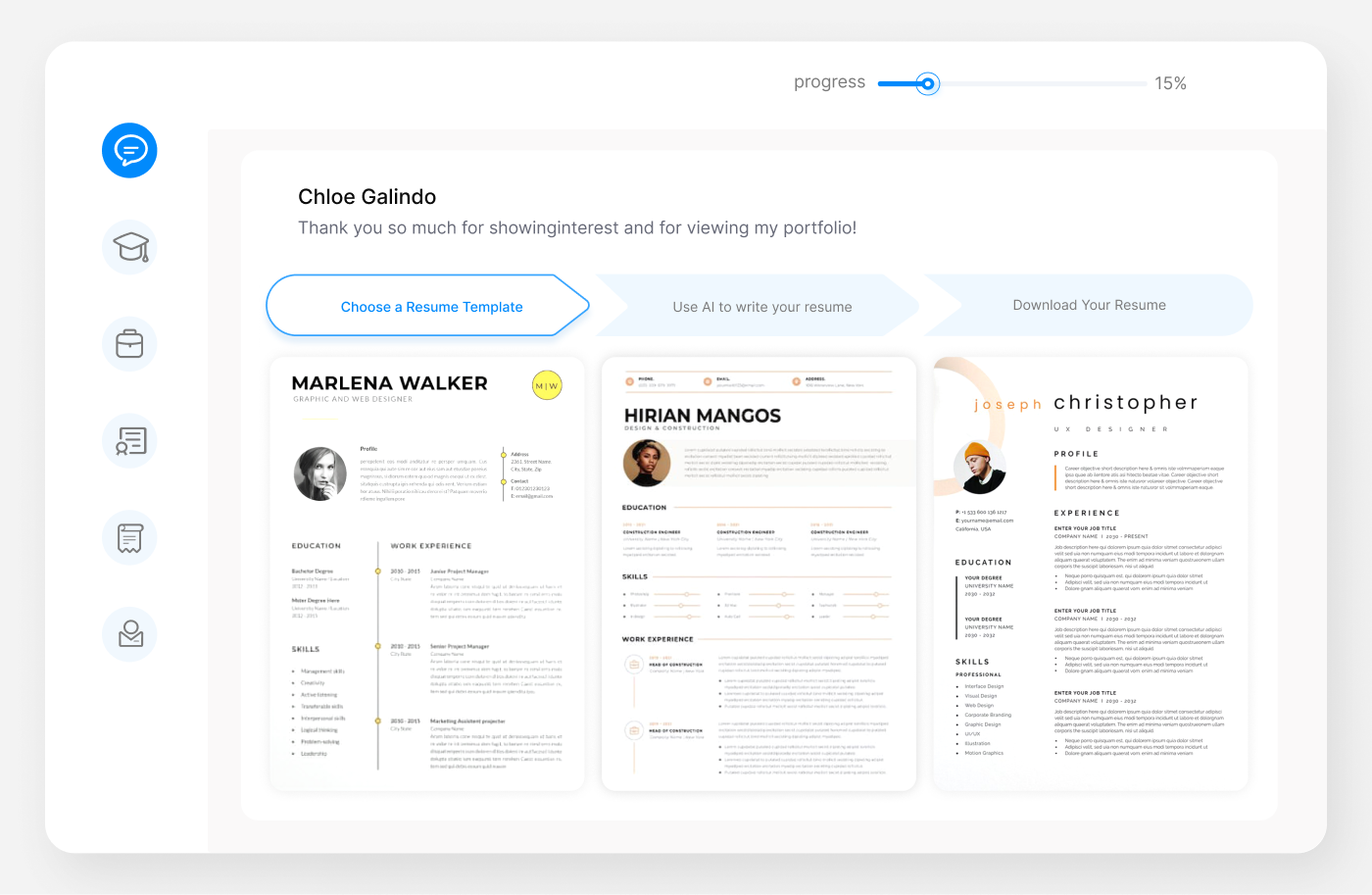

Choose the Right Format and Layout

The three most common resume formats are chronological, functional, and combination. For bank managers with a solid career progression, a chronological format is often best, as it showcases career growth and professional achievements. However, if you're transitioning from another field into banking, a combination format can help highlight relevant skills and experiences that transfer across industries.

Regardless of the format, your resume should be easy to read and professionally presented. Use a clean, modern font like Arial or Calibri at a size of 10 to 12 points, and ensure there's enough white space to make the document not appear overcrowded. Bullet points are your friends when it comes to listing achievements or responsibilities, as they help break up the text and make your resume more skimmable.

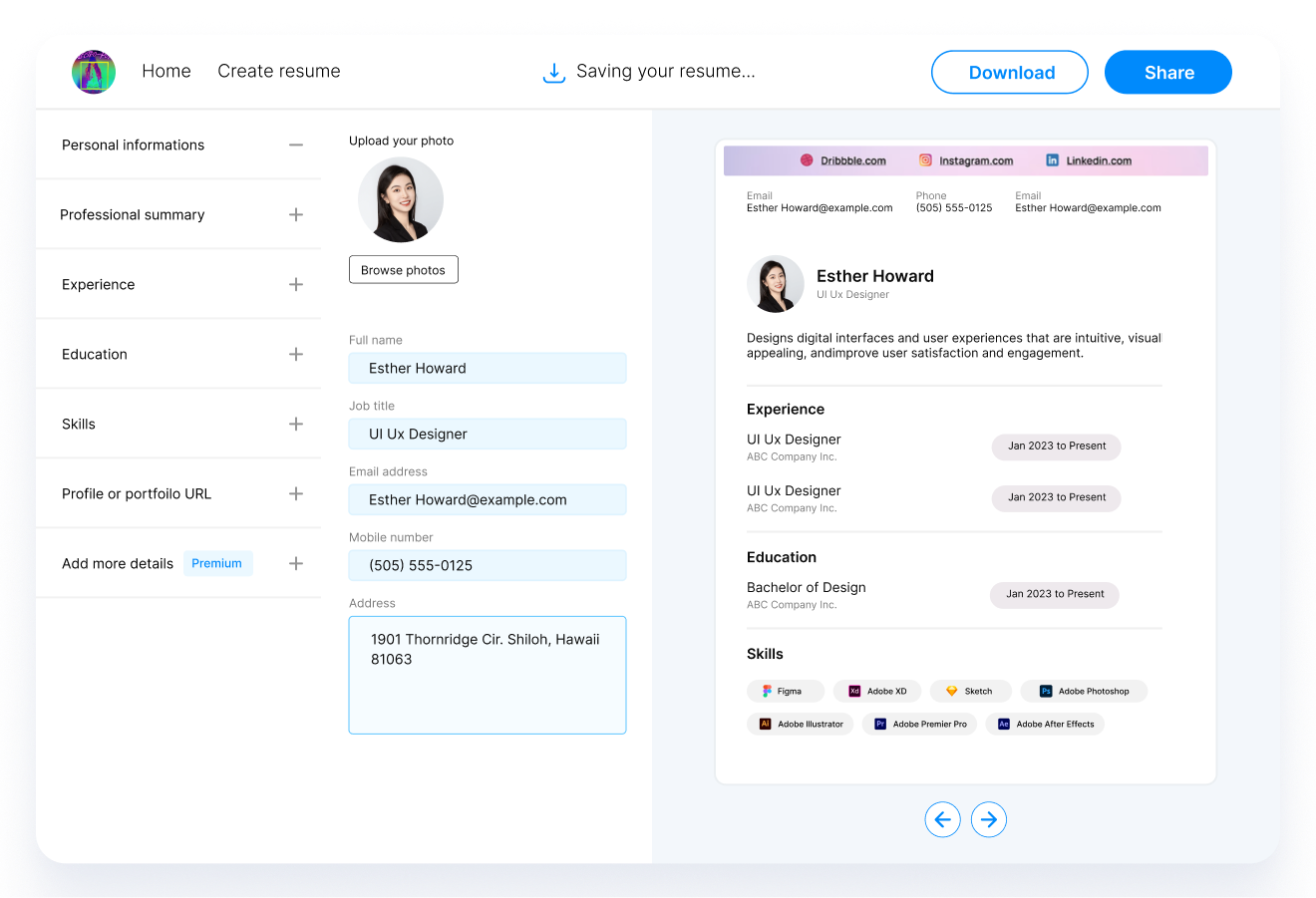

Prioritize the Most Important Information

At the top of your resume, immediately after your contact information, include a powerful objective or summary statement. This should succinctly highlight your most relevant experiences, skills, and career goals. It's your elevator pitch to the hiring manager, so make it count.

Your professional experience section should follow, listing your positions in reverse chronological order. For each role, include your title, the company's name, location, and the dates of employment. Underneath, bullet points should detail your responsibilities and, more importantly, your achievements. Use specific metrics and examples where possible, such as "increased loan portfolio by 20% through strategic relationship building with local businesses."

Education and Continuous Learning

In the finance sector, ongoing education and certifications can set you apart from other candidates. List your degrees in reverse chronological order, including any relevant certifications or ongoing professional development courses. For bank managers, certifications such as the Certified Bank Manager (CBM) or Project Management Professional (PMP) can be particularly valuable.

Highlighting the Right Skills

The skills section of your resume should be tailored to the job you're applying for. Include a mix of hard skills (like financial analysis or risk management) and soft skills (such as leadership or communication). Remember, the job description is your best clue to what the employer values most.

Additional Sections That Add Value

Consider including additional sections if they add value to your candidacy. This could be professional memberships, awards, or even relevant volunteer work. For example, membership in the American Bankers Association demonstrates your commitment to the profession, while volunteer work as a financial advisor for a non-profit can showcase leadership and financial planning skills outside of a corporate setting.

The Importance of a Cover Letter

Don't forget the cover letter. While not always required, a well-crafted cover letter can provide further context to your resume and allow you to elaborate on particularly significant achievements or projects. It's another opportunity to sell yourself to the hiring manager.

By following these guidelines and structuring your resume strategically, you'll position yourself as a strong candidate for any bank manager position. Remember, your resume is your personal marketing document—it should not only reflect your career to date but also your aspirations for the future.

Crafting Your Career Synopsis: The Art of the Perfect Bank Manager Resume Summary

The resume summary or objective is more than a mere introduction; it's your chance to capture the hiring manager's attention and make them want to learn more about you. For bank managers, this section should succinctly highlight leadership capabilities, financial expertise, and a proven track record of improving operational efficiency and customer satisfaction. Here are key elements to include:

Showcase Your Experience

Begin with a statement that highlights your years of experience and key areas of expertise. For example, "Seasoned Bank Manager with over 10 years of experience in enhancing operational efficiency, team leadership, and customer satisfaction in the banking sector."

Highlight Key Achievements

Include one or two of your most significant achievements that are relevant to the role you're applying for. Quantify these achievements with specific metrics to provide a clear picture of your capabilities. For instance, "Led a team to increase loan portfolio by 25% within one fiscal year through strategic client relationship management and innovative financial product development."

Mention Your Career Goals

Tailor this section to the specific bank and position you're applying for, demonstrating your enthusiasm for the role and how you intend to contribute to the bank's success. "Seeking to leverage extensive experience in financial management and strategic planning to drive growth and efficiency at XYZ Bank."

By crafting a compelling summary or objective, you provide a strong opening to your resume that aligns your experience and goals with the needs of the employer, setting the stage for the detailed accomplishments and skills that follow.

Example of a Bank Manager Resume Summary

Dynamic Bank Manager with 12 years of experience specializing in client relations, financial strategy development, and team leadership. Successfully managed a branch that achieved a 30% increase in customer satisfaction and a 20% growth in annual revenue. Adept at navigating complex financial landscapes to drive business success and profitability. Eager to bring expertise to a forward-thinking bank where innovative management strategies are valued.

This tailored approach not only showcases your qualifications and achievements but also demonstrates your commitment to contributing to the prospective employer's success, making your resume stand out in the competitive finance job market.

Crafting a Winning Work Experience Section for Your Bank Manager Resume

The work experience section is the heart of your resume, showcasing your professional journey and achievements. For bank managers, this section must not only highlight managerial skills but also demonstrate expertise in financial operations, customer service, and team leadership. Here’s how to construct a compelling work experience section:

Focus on Achievements, Not Just Duties

Rather than listing daily tasks, emphasize the outcomes and achievements in each role. Use action verbs to start each bullet point, and quantify results wherever possible to provide concrete evidence of your impact.

Tailor Your Experience to the Job Description

Align your listed experiences with the requirements of the job you're applying for. This means emphasizing aspects of your previous roles that are most relevant to the bank manager position, such as financial management, strategic planning, and customer relations.

Use Specific Examples and Metrics

Concrete examples and metrics grab attention and make your achievements more tangible. For instance, rather than saying “increased sales,” specify “increased loan portfolio sales by 30% through targeted customer outreach and relationship building.”

Demonstrate Leadership and Team Management

As a manager, your ability to lead and develop a team is crucial. Highlight examples of how you’ve mentored staff, improved team efficiency, or led successful projects.

Example Work Experience for a Bank Manager Resume

Bank Manager

Citywide Bank, New York, NY

March 2015 - Present

- Spearheaded a customer service initiative that resulted in a 40% improvement in customer satisfaction scores.

- Managed a team of 25 employees, fostering a culture of continuous improvement and professional development that reduced staff turnover by 20%.

- Implemented a new CRM system, increasing the branch's loan processing efficiency by 15%.

- Developed and executed a local marketing strategy that increased the branch's deposit base by $10 million.

Addressing Gaps or Changes in Your Career Path

If you have gaps in your employment or have changed industries, don’t try to hide it. Instead, focus on the transferable skills and knowledge you gained during those periods. Volunteer work, further education, or freelance projects can also be included if they demonstrate relevant skills or experiences.

By carefully crafting your work experience section to highlight your achievements, leadership skills, and impact, you’ll show potential employers not just where you’ve been, but what you’re capable of contributing to their organization.

Building the Foundation: Highlighting Your Education on a Bank Manager Resume

The education section of your resume is more than just a list of degrees; it's an opportunity to showcase the foundational knowledge and skills that have prepared you for a leadership role in banking. While the focus for a bank manager might lean more heavily on professional experience, your educational background still plays a critical role, especially if it includes degrees or coursework relevant to finance, business, or management.

Structuring Your Education Section

- List Degrees in Reverse Chronological Order: Start with your most recent degree and work backwards. This is standard practice for resume writing and helps hiring managers quickly understand your most advanced level of education.

- Include Relevant Details: For each degree, list the school's name, your degree, and your graduation year. If you graduated recently and had a particularly strong GPA, you can include that as well.

- Highlight Relevant Coursework, Honors, and Achievements: If you're newer to the workforce, you can include relevant coursework, honors, or other achievements that demonstrate your preparedness for the bank manager role. However, as your career progresses, these details become less necessary.

Tailoring Your Education to the Job

If the job posting emphasizes a need for specific skills or knowledge areas (like risk management, financial analysis, or business administration), and your education aligns with these areas, make sure to highlight that connection. If you've taken courses or completed a thesis related to these areas, mention them.

Examples of Education on a Bank Manager Resume

MBA, Finance Concentration

University of Chicago Booth School of Business

Chicago, IL | Graduated 2018

- Selected Courses:

- Advanced Corporate Finance,

- Strategic Management of Financial Institutions,

- Risk Management.

Bachelor of Science in Business Administration

University of California

Berkeley, Berkeley, CA | Graduated 2014

- Honors:

- Summa Cum Laude,

- Dean's List every semester.

Including Continuing Education and Professional Development

The banking and finance sector is ever-evolving, and continuous learning is crucial. If you have completed professional development courses, certifications (such as Certified Bank Manager or Project Management Professional), or attended industry conferences, these can also be included in your education section or a separate "Professional Development" section. This shows your commitment to staying current in your field.

Example of an Education Section

Education and Professional Development for a Bank Manager Resume

Master of Business Administration (MBA), Finance

Stanford University Graduate School of Business

Stanford, CA | 2020

- Leadership Award recipient for outstanding leadership capabilities demonstrated through academic projects.

Bachelor of Arts in Economics

University of Pennsylvania

Philadelphia, PA | 2016

- Graduated Magna Cum Laude.

- President of the Economics Club, leading discussions on current financial issues and industry trends.

Certifications:

Certified Bank Manager (CBM)

- American Institute of Banking | 2021

Project Management Professional (PMP)

- Project Management Institute | 2019

This section demonstrates not only a solid foundation in education but also a commitment to ongoing professional development, both of which are key to success in the dynamic field of banking management.

Mastering the Skill Set: Highlighting Your Abilities in a Bank Manager Resume

For bank managers, a well-crafted skills section is a pivotal component of the resume. This part of your document spotlights the specific abilities that qualify you for a managerial role in the banking sector. It's not just about listing skills; it’s about choosing those that are most relevant to the position you're applying for and presenting them in a way that catches the eye of hiring managers. Here’s how to fine-tune your skills section:

Identifying Your Core Skills

Start by making a comprehensive list of your skills, then narrow it down to those most pertinent to a bank manager's role. Generally, these can be divided into hard skills (specific, teachable abilities or knowledge bases) and soft skills (personality traits and behaviors). For a bank manager, relevant hard skills might include financial analysis, risk management, and regulatory compliance, while essential soft skills could cover leadership, communication, and problem-solving.

Matching Skills with Job Descriptions

Carefully review the job listing for the bank manager position you're targeting. Employers often list specific skills they're looking for in candidates. Make sure the skills you highlight in your resume align with these requirements. This not only shows that you're a good fit for the role but also helps your resume get past Applicant Tracking Systems (ATS) that screen for keywords.

Quantifying and Qualifying Your Skills

Whenever possible, provide context for your skills by associating them with specific achievements or responsibilities from your work history. For example, rather than simply listing "risk management," you might say, "Skilled in risk management, having successfully navigated the branch through the 2008 financial crisis with minimal loan defaults."

Examples of Skills for a Bank Manager Resume

Hard Skills:

- Financial Analysis

- Risk Management

- Regulatory Compliance

- Loan Origination and Servicing

- Budgeting and Forecasting

Soft Skills:

- Leadership and Team Building

- Effective Communication

- Strategic Planning

- Problem-Solving

- Customer Service Excellence

Structuring the Skills Section

Your skills section should be easy to scan, so consider formatting it in a bullet-point list. If you have a mix of hard and soft skills, you might separate them into two subsections for clarity. Remember, this section is an overview; you can provide more detailed examples of how you've applied these skills in the work experience section.

Tailoring Skills to the Banking Sector

Bank management requires a unique set of skills, blending financial acumen with customer service and team leadership. Ensure that the skills you list reflect the balance needed for this role. For instance, emphasizing your experience with financial software is relevant, but so is showcasing your ability to mentor and develop staff.

By thoughtfully selecting and presenting your skills, you demonstrate to potential employers that you possess the comprehensive skill set required for effective bank management. This clarity and focus can significantly enhance the impact of your resume, setting you apart in a competitive job market.

Elevating Your Bank Manager Resume with Additional Sections

Your resume's additional sections can significantly bolster your application, offering a more comprehensive view of your qualifications beyond the standard experience and education. For bank managers, these sections can highlight certifications, awards, volunteer work, or professional affiliations, providing further evidence of your expertise and commitment to the field. Here’s how to make the most of these extra segments:

Certifications

Certifications can greatly enhance your resume, showcasing your commitment to ongoing education and excellence in your field. For bank managers, relevant certifications might include:

- Certified Bank Manager (CBM)

- Project Management Professional (PMP)

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

Include the certifying body and the year you obtained the certification. For certifications that require renewal, it's also helpful to include the expiration date to show that your certification is current.

Professional Affiliations

Membership in professional organizations can demonstrate your commitment to the banking industry and your dedication to professional development. Consider including memberships such as:

- American Bankers Association (ABA)

- The Institute of Internal Auditors (IIA)

- National Association of Credit Management (NACM)

These affiliations can also signal to potential employers that you're well-connected and up-to-date on industry trends and standards.

Awards and Honors

Including awards and honors you’ve received for your work or contributions to the banking sector can set you apart from other candidates. Whether it’s a “Manager of the Year” award from your company or recognition from a professional organization, these accolades speak volumes about your expertise and dedication.

Volunteer Experience

Volunteer work, especially if it’s related to finance or leadership, can be a valuable addition to your resume. It demonstrates your willingness to engage with your community and can showcase skills that are relevant to bank management, such as leadership, financial planning, or education.

Languages

Proficiency in additional languages can be a significant asset, especially in communities with a diverse clientele or for banks with a global reach. Include your language skills and your level of proficiency.

Example of an Additional Sections for a Bank Manager Resume

Certifications:

- Certified Bank Manager (CBM)

- American Bankers Association, 2020

- Project Management Professional (PMP)

- Project Management Institute, 2018

Professional Affiliations:

- Member, American Bankers Association (ABA)

- Member, National Association of Credit Management (NACM)

Awards:

- Manager of the Year, First National Bank, 2019

Volunteer Experience:

- Financial Literacy Instructor, Local Community Center, 2018-Present

Languages:

- Fluent in Spanish and French

By including these additional sections, you not only provide a fuller picture of your qualifications but also demonstrate a well-rounded character, professional engagement, and a commitment to excellence. These details can make a significant difference in how hiring managers perceive your application, potentially tipping the scales in your favor.

The Crucial Companion: Crafting a Compelling Cover Letter for Your Bank Manager Application

A cover letter can be a game-changer in your job application process, providing a personalized narrative to complement your resume. For a bank manager role, it’s an opportunity to showcase your leadership philosophy, highlight significant achievements, and demonstrate your enthusiasm for the position. Here’s how to craft a cover letter that resonates with hiring managers:

Start with a Strong Opening

Your opening paragraph should grab the reader's attention. Start with your most compelling professional achievement or a statement that reflects your enthusiasm for the role. For example, "Leading a branch to achieve the highest customer satisfaction ratings in its region was one of my proudest moments as a bank manager."

Tailor Your Message

Customize your cover letter for each application. Research the bank and mention specific reasons why you’re excited about the opportunity to work there. Highlight how your experience and values align with the bank's culture and goals.

Showcase Key Achievements

Use your cover letter to expand on one or two significant achievements listed on your resume. Provide context, share the challenges you faced, the actions you took, and the results of your efforts. This storytelling approach can make your application more memorable.

Demonstrate Your Leadership and Management Skills

Bank managers need to be effective leaders. Share examples of how you’ve mentored staff, driven operational improvements, or implemented strategies that enhanced customer satisfaction and financial performance.

Address the Bank's Needs

Your cover letter should respond to the needs and challenges specific to the bank you're applying to. If the job listing emphasizes a need for innovation, discuss how you’ve introduced new technologies or processes in past roles. If community engagement is a priority, highlight your experience in community service or local initiatives.

Close with a Call to Action

End your cover letter on a proactive note, expressing your eagerness to discuss how you can contribute to the bank's success. For instance, "I am keen to bring my expertise in financial management and customer service excellence to [Bank Name] and would welcome the opportunity to discuss how I can contribute to your team."

Example of a Cover Letter Opening for a Bank Manager

Cover Letter Opening Example for a Bank Manager

Dear [Hiring Manager's Name],

With over a decade of proven success in leading bank branches to exceed customer satisfaction and financial goals, I was excited to see [Bank Name]'s posting for a Bank Manager. At [Previous Employer], I spearheaded initiatives that resulted in a 30% increase in customer retention and a 20% growth in loan portfolios, aligning closely with [Bank Name]'s commitment to excellence and community service. I am eager to bring my leadership skills and financial expertise to contribute to the continued success of [Bank Name].

Your cover letter is not just a formality but a strategic tool that can significantly impact your job application. By crafting a personalized, engaging, and relevant cover letter, you can set yourself apart from other candidates and make a strong case for why you are the ideal candidate for the bank manager position.

Final Reflections: Cementing Your Position as the Ideal Candidate

After meticulously crafting each section of your bank manager resume and complementing it with a persuasive cover letter, it's crucial to reflect on the overall package you're presenting to potential employers. Your resume and cover letter are not just documents; they're your professional narrative, telling the story of your career journey, achievements, and aspirations. Here's how to ensure your application resonates with hiring managers and positions you as the standout candidate.

Review and Customize Your Application

Before submitting your application, review each section of your resume and cover letter to ensure they're customized for the bank manager role you're applying for. Tailoring your application shows hiring managers that you've taken the time to understand their needs and how your skills and experiences align with their goals.

Highlight Your Unique Contributions

Consider what sets you apart from other candidates. Perhaps it's your innovative approach to team leadership, your track record of enhancing customer satisfaction, or your expertise in financial product development. Make sure these unique contributions are clearly articulated in your resume and cover letter.

Emphasize Your Commitment to the Banking Sector

Demonstrate your passion for banking and your commitment to continuous learning and professional development. Mention any industry-related activities, memberships, or certifications that show you're engaged with the broader banking community and committed to staying at the forefront of industry trends and best practices.

Proofread and Get Feedback

A well-polished application is free from typos and grammatical errors, which can detract from your professionalism. Proofread your documents thoroughly and consider getting feedback from mentors, colleagues, or professional contacts within the banking sector. An external perspective can provide valuable insights and help you refine your application.

Prepare for the Next Steps

As you submit your application, start preparing for potential interviews. Reflect on the examples and achievements you've highlighted in your resume and cover letter, considering how you can discuss these in more depth during an interview. Think about how you can convey your enthusiasm for the role and your readiness to contribute to the bank's success.

By approaching your application with thoughtfulness and strategic focus, you're not just applying for a job; you're positioning yourself as the ideal candidate for the bank manager role. This comprehensive and reflective approach ensures that your application not only catches the eye of hiring managers but also truly represents your professional persona and career aspirations.

Addressing Common Queries: Your Guide to Bank Manager Resume Writing

Navigating the process of crafting a resume for a bank manager position can prompt a variety of questions, especially regarding how to best highlight your skills, experiences, and qualifications. Here’s a detailed exploration of common queries related to writing an effective bank manager resume and cover letter, providing you with deeper insights and guidance.

How Can I Make My Resume Stand Out to Employers?

Focus on Achievements: Instead of just listing job duties, highlight your achievements with specific metrics and examples. Show how you contributed to your previous employer's success, such as improving customer satisfaction scores or increasing branch revenue.

Tailor Your Resume: Customize your resume for each application, emphasizing the skills and experiences that align with the job description. Use keywords from the job listing to ensure your resume passes through Applicant Tracking Systems (ATS).

Professional Formatting: Use a clean, professional format with clear headings and bullet points. A well-organized resume makes it easier for hiring managers to scan and find important information.

What Should I Include in My Cover Letter?

Personalize Your Letter: Address the cover letter to the hiring manager by name, if possible. Show that you’ve done your homework by mentioning specific details about the bank and how you can contribute to its goals.

Highlight Key Experiences: Use your cover letter to expand on significant achievements from your resume. Share stories or examples that demonstrate your leadership, problem-solving skills, and commitment to excellence in banking.

Explain Your Motivation: Discuss why you’re excited about the opportunity to work as a bank manager at this particular institution. Show how your career goals align with the bank's mission and values.

How Do I Address Gaps in My Employment?

Be Honest and Positive: If you have gaps in your employment, be honest about them. Focus on what you learned or how you grew during those periods. For example, if you took time off for further education, highlight the skills and knowledge you gained.

Use a Cover Letter to Your Advantage: Your cover letter can be a useful tool to explain employment gaps in a positive light, especially if the experiences during the gap period (like volunteering or independent projects) have contributed to your professional development.

Can I Include Volunteer Work on My Resume?

Absolutely: Volunteer work, particularly if it’s relevant to banking or leadership, can be a valuable addition to your resume. It demonstrates your commitment to the community and can showcase transferable skills that are applicable to the bank manager role.

How Often Should I Update My Resume?

Regularly: It’s a good practice to update your resume regularly, even when you’re not actively job searching. Adding new skills, certifications, and achievements as they occur ensures your resume is always ready for new opportunities.

By addressing these common questions and concerns, you’re better equipped to craft a resume and cover letter that not only showcase your qualifications and experiences but also resonate with potential employers in the banking sector. Remember, your resume and cover letter are your personal marketing tools, designed to highlight your strengths and position you as the ideal candidate for your next bank manager role.

Recommended Reading