In the competitive world of Accounting & Finance, standing out as a Controller requires more than just a solid background in finance and accounting. It's about presenting your experience, skills, and accomplishments in a way that speaks directly to the needs and challenges of employers. This guide is your roadmap to crafting a resume that not only showcases your qualifications but also highlights your ability to drive financial efficiency and organizational growth. From structuring your resume for impact to detailing your professional journey with precision, we'll walk you through each step of creating a resume that opens doors.

Controller Resume Sample

Amanda Lee, CPA

San Francisco, CA | (415) 555-1234

amanda.lee@example.com

LinkedIn.com/in/amandalee-cpa

PROFESSIONAL SUMMARY

Certified Public Accountant with over 10 years of experience in financial management, specializing in corporate accounting, financial planning, and strategic analysis. Proven track record of improving financial processes, enhancing productivity, and implementing financial solutions that support business objectives. Skilled in leading finance teams, developing financial strategies, and communicating financial insights to executive teams to facilitate informed decision-making.

WORK EXPERIENCE

Senior Controller

Quantum Industries

San Francisco, CA

April 2016 – Present

- Lead a finance team of 15, overseeing all aspects of financial management, including corporate accounting, regulatory and financial reporting, budget and forecasts preparation, as well as development of internal control policies and procedures.

- Enhanced financial reporting processes, reducing closing time by 30% while maintaining accuracy in all financial reports.

- Played a key role in strategic planning, providing critical financial and operational information with actionable recommendations to the executive team.

- Managed and completed external audits, ensuring compliance with GAAP and applicable federal, state, and local regulatory laws and rules for financial and tax reporting.

Financial Controller

Helios Energy Solutions

Oakland, CA

July 2010 – March 2016

- Responsible for the accounting operations of the company, including the production of periodic financial reports, maintenance of an adequate system of accounting records, and a comprehensive set of controls designed to mitigate risk.

- Improved budgeting process through the introduction of comprehensive financial metrics and quarterly business reviews that resulted in a 20% increase in year-over-year revenue.

- Spearheaded the implementation of a new financial management system, resulting in improved financial accuracy and a 25% reduction in financial reporting times.

EDUCATION

Master of Business Administration (MBA), Finance

University of California, Berkeley | May 2010

Bachelor of Science in Accounting

San Francisco State University | May 2008

Certified Public Accountant (CPA)

SKILLS

- Financial Reporting & Analysis

- Budgeting and Forecasting

- Strategic Planning & Analysis

- Financial Modelling

- Team Leadership & Development

- Regulatory Compliance

- GAAP & Financial Principles

- ERP Systems & Technologies

CERTIFICATIONS

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- In Progress

PROFESSIONAL MEMBERSHIPS

- American Institute of CPAs (AICPA)

- California Society of CPAs

Crafting a Resume that Opens Doors: The Art of Structure and Clarity

In the competitive field of Accounting & Finance, particularly for a role as pivotal as that of a Controller, your resume is your first interaction with potential employers. It's your chance to make a strong first impression and to stand out in a sea of candidates. Structuring your resume with clear formatting and strategic organization is not just recommended; it's essential. Here's how to ensure your resume not only gets noticed but also makes a compelling case for your candidacy.

Importance of a Well-Structured Resume

A well-structured resume facilitates a seamless reading experience, guiding the hiring manager through your professional journey with ease. It highlights your strengths and achievements in a manner that aligns with the needs of the employer. Think of your resume as a marketing tool, one that has been finely tuned to sell your skills, experience, and potential impact to your prospective employer.

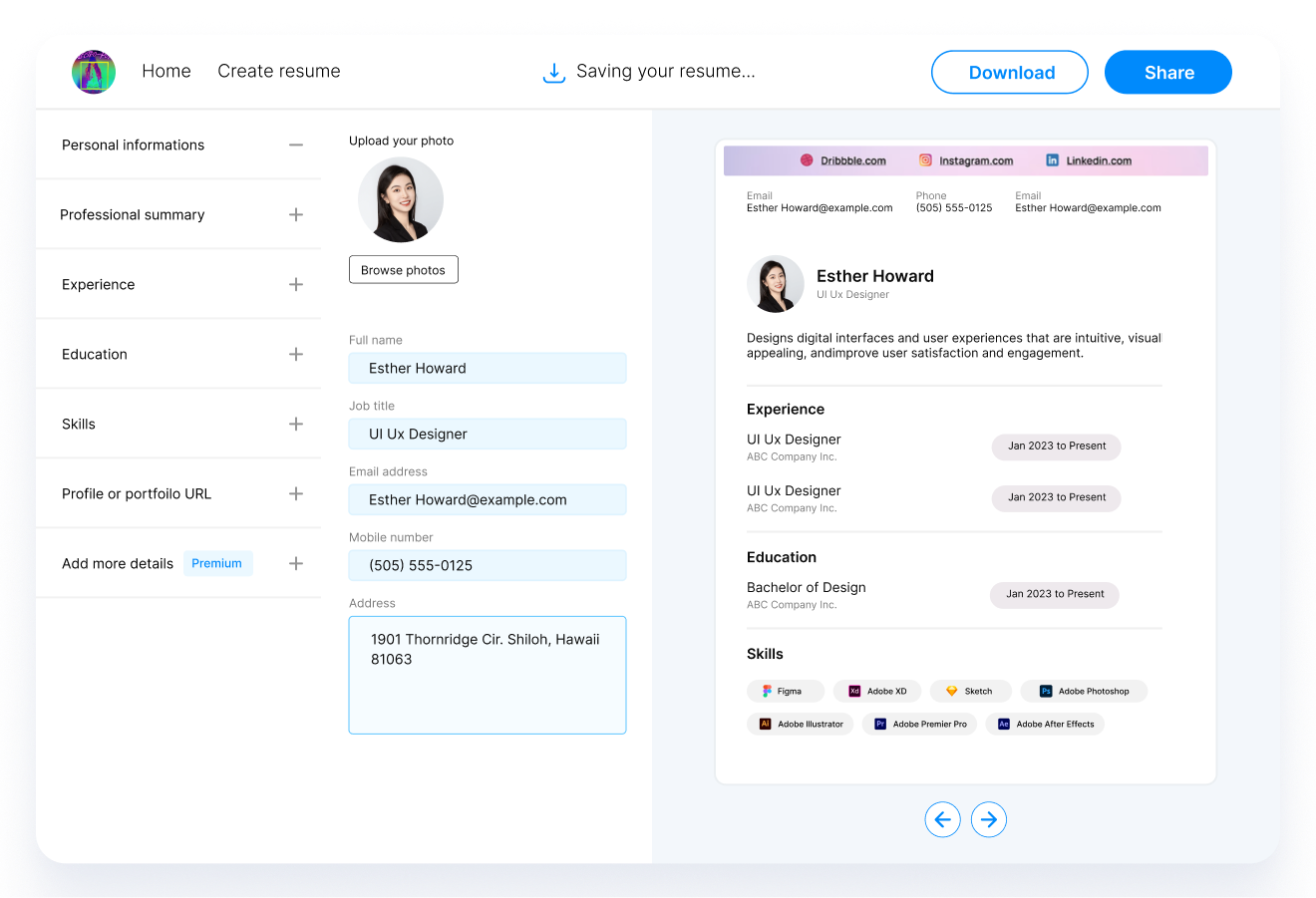

The Basics of Resume Structure

Your resume should include several key sections: Contact Information, Professional Summary or Objective, Work Experience, Education, Skills, and any Additional Sections that might strengthen your application such as Certifications, Professional Memberships, and Volunteer Experience.

- Contact Information: Place this at the very top. Include your name, phone number, email, and LinkedIn profile. Ensure this information is accurate and professional.

- Professional Summary or Objective: This is your elevator pitch. In a few concise sentences, highlight your most significant achievements, skills, and what you aim to bring to the position.

- Work Experience: List this in reverse chronological order. Focus on achievements rather than just duties. Use bullet points to make this section easy to scan.

- Education: Detail your highest degree first, followed by any relevant certifications or continued education. If you've been in the workforce for some time, keep this section brief.

- Skills: List skills that are relevant to the job you’re applying for, including both hard and soft skills. Be specific and honest about your proficiency.

- Additional Sections: This is where you can include any certifications, languages, or volunteer work that may give you an edge over other candidates.

Tailoring Your Resume

One size does not fit all when it comes to resumes. Tailor your resume for each job application. This means highlighting the experience and skills that are most relevant to the job description. Use keywords from the job listing to pass through Applicant Tracking Systems (ATS) and catch the eye of the hiring manager.

Formatting for Clarity and Impact

Use a clean, professional format with clear headings and consistent font use. Ensure your resume is easy to read at a glance, which means liberal use of bullet points, and keep your descriptions concise. The ideal resume length is one to two pages, depending on your experience level.

Conclusion

Your resume for a Controller position in the Accounting & Finance sector is more than a list of past jobs; it's a strategic tool designed to showcase your qualifications, achievements, and potential value to a prospective employer. By focusing on clarity, structure, and relevance, you can create a resume that not only captures the attention of hiring managers but also positions you as a compelling candidate for the role.

Mastering the Art of Crafting a Powerful Resume Summary or Objective

A resume summary or objective serves as the opening statement of your resume, setting the tone for everything that follows. This section can make a significant impact on your application, especially for strategic roles like a Controller in the Accounting & Finance sector. It's your chance to capture the hiring manager's attention and make them want to learn more about you. Here's how to write a compelling summary or objective that highlights your qualifications and ambition.

The Difference Between a Summary and an Objective

- Resume Summary: Ideal for experienced professionals, a resume summary highlights your achievements, skills, and what you bring to a potential employer. It's a brief overview of your most compelling attributes.

- Resume Objective: More suited for early-career professionals or those making a career change, a resume objective focuses on your career goals and how you plan to achieve them while contributing to the company.

Crafting a Compelling Resume Summary

When writing a resume summary, your goal is to condense your most significant achievements and skills into a few impactful sentences. Here's how:

- Start with Your Title and Experience: Briefly mention your current job title and years of experience.

- Highlight Key Achievements: Mention one or two major achievements or skills you possess, with metrics if possible (e.g., "Led financial restructuring that increased company revenue by 20%").

- Tailor It to the Job Description: Incorporate keywords and skills from the job listing to make your summary as relevant as possible to the position you’re applying for.

Writing an Effective Resume Objective

An objective can be a powerful tool if you’re early in your career or looking to change industries. Here's how to make it work for you:

- State Your Career Goals: Be clear about what you aim to achieve in your career and how you plan to contribute to the potential employer.

- Focus on Your Skills: Highlight the skills and knowledge you bring to the table, especially those that align with the job listing.

- Make It Specific: General statements won’t stand out. Tailor your objective to the specific role and company you’re applying to.

Examples for Inspiration

Resume Summary Example for a Controller

"Detail-oriented Controller with over 12 years of experience in financial management and strategic planning. Proven track record in optimizing financial processes and enhancing reporting accuracy, leading to a 25% increase in efficiency in previous roles. Skilled in leading cross-functional teams to achieve financial objectives and improve bottom-line results."

Resume Objective Example for an Aspiring Controller

"Highly motivated finance professional with a strong foundation in accounting principles and financial analysis. Eager to leverage my expertise in budget management and cost reduction strategies to contribute to the financial success of [Company Name]. Committed to developing efficient financial systems and processes."

Conclusion

Whether you choose to write a summary or an objective, the key is to make it relevant, compelling, and tailored to the role and company. This section is your elevator pitch; make it count by succinctly showcasing your value as a candidate. A well-crafted summary or objective can significantly boost your chances of catching the hiring manager's eye and securing an interview.

Showcasing Your Work Experience: A Blueprint for Success

The work experience section is the backbone of your resume, especially for a Controller position in the Accounting & Finance sector. It's where you demonstrate your professional trajectory, highlighting your achievements, responsibilities, and the value you've brought to previous employers. Crafting this section with care and precision can significantly elevate your resume from good to exceptional. Here's how to showcase your work experience effectively.

Emphasize Achievements Over Duties

- Focus on what you've accomplished in your roles rather than just listing your duties. Use quantifiable results to illustrate your impact. For example, "Implemented a new financial reporting system that reduced monthly close times by 30%" is more impactful than "Responsible for monthly financial reporting."

Use Action Verbs

- Start each bullet point with a strong action verb that conveys your role in each achievement. Words like "Led," "Managed," "Improved," and "Developed" showcase your initiative and leadership.

Tailor Your Experience to the Job

- Align your work experience with the requirements of the job you're applying for. Highlight the most relevant experiences and achievements that demonstrate your qualifications for the Controller position.

Quantify Your Impact

- Whenever possible, use numbers and metrics to quantify your contributions. Financial gains, percentages, time saved, and efficiency improvements are compelling data points that can make your resume stand out.

Format for Readability

- Use bullet points to structure your achievements, making your resume easier to read quickly. Keep your descriptions concise but impactful, focusing on the highlights of each role.

Include Relevant Keywords

- Integrate keywords from the job description into your work experience section. This not only tailors your resume to the position but also helps it pass through Applicant Tracking Systems (ATS) that many companies use to screen resumes.

Example of a Well-Crafted Work Experience Section

Senior Controller

Quantum Industries

San Francisco, CA

April 2016 – Present

- Spearheaded the development and implementation of a streamlined financial reporting process, reducing closing times by 30% and improving report accuracy.

- Led a cross-functional team in a company-wide budget overhaul, identifying inefficiencies and reallocating resources to save $2M annually.

- Collaborated with IT to introduce advanced financial modeling tools, enhancing strategic decision-making and forecasting accuracy.

- Managed external audits, ensuring full compliance with GAAP and federal regulations, resulting in zero findings over four consecutive years.

Conclusion

The work experience section is your opportunity to showcase your professional journey and the value you've added to previous organizations. By focusing on achievements, using action verbs, quantifying your impact, and tailoring your experiences to the job at hand, you can create a compelling narrative that positions you as an ideal candidate for the Controller role.

Illuminating Your Academic Journey: The Education Section Unveiled

In the realm of Accounting & Finance, particularly for roles as pivotal as a Controller, the education section of your resume carries significant weight. While your work experience demonstrates your professional journey and achievements, your education provides the foundational knowledge and technical expertise necessary for high-level financial management and decision-making. Here's how to effectively showcase your educational background, ensuring it supports your candidacy and demonstrates your readiness for the challenges of the Controller role.

Structuring Your Education Section

- List Highest Degree First: Begin with your most advanced degree, working backward to your least. Include the degree type, your major, the institution's name, and your graduation year.

- Highlight Relevant Coursework and Achievements: If you've taken courses directly relevant to the role of a Controller or achieved notable academic accolades, include these details. This is particularly useful for recent graduates or those with less work experience.

- Certifications and Continuing Education: For a Controller, certifications such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant) can be crucial. Include any certifications you have, along with any ongoing or additional education that pertains to the role.

The Role of Education in Your Controller Resume

For a Controller, the education section isn't just about ticking boxes; it's about showcasing a solid foundation in accounting principles, financial management, and strategic planning. It's proof of your technical proficiency and your commitment to professional development—a key trait for anyone aspiring to lead in the Accounting & Finance sector.

Example: Highlighting Your Education

Master of Business Administration (MBA), Finance

University of California, Berkeley, 2020

- Specialized in corporate financial management and strategic planning

- Completed a capstone project on financial restructuring in the manufacturing sector, resulting in a 20% improvement in efficiency for the partner company

Bachelor of Science in Accounting

San Francisco State University, 2018

- Graduated Summa Cum Laude

- President, Student Accounting Society

Certifications: The Competitive Edge

In a field as competitive and specialized as finance, certifications can significantly enhance your resume. They serve as an endorsement of your skills and knowledge, setting you apart from other candidates. For roles like a Controller, consider including:

- CPA (Certified Public Accountant)

- CMA (Certified Management Accountant)

- ACCA (Association of Chartered Certified Accountants) certification

Tailoring Your Education to the Role

While your education section is fundamentally a record of your academic achievements, tailoring this section to the Controller role can further enhance your candidacy. Emphasize aspects of your education that are most relevant to the responsibilities and challenges of the position, such as leadership in financial strategy, expertise in accounting standards, or proficiency in financial software and tools.

Conclusion

Your education section is a testament to your preparedness for the complex and demanding role of a Controller. By effectively showcasing your academic background, relevant coursework, and certifications, you signal to potential employers your commitment to excellence and your readiness to lead in the Accounting & Finance sector.

Highlighting Your Financial Acumen: The Skills Section Decoded

In the finance and accounting world, especially for a position as crucial as a Controller, the skills section of your resume is your chance to showcase the specific abilities that make you the perfect candidate for the job. This section should be a carefully curated list of your competencies, particularly those that directly align with the job description. Here's how to effectively highlight your skills to catch the eye of hiring managers and demonstrate your readiness to take on the responsibilities of a Controller.

Identifying Your Core Skills

A Controller's role encompasses a broad range of responsibilities, from overseeing accounting operations to strategic financial planning and analysis. Your skills section should reflect both the technical expertise and soft skills necessary for this multifaceted position. Consider including:

- Financial Reporting and Analysis: Demonstrating your ability to prepare, analyze, and present financial statements in compliance with regulatory requirements.

- Budgeting and Forecasting: Showcasing your skills in developing accurate budgets and financial forecasts to guide business strategy.

- Strategic Planning: Highlighting your ability to contribute to long-term business planning and financial strategy.

- Internal Controls and Compliance: Your knowledge of and experience with establishing and maintaining internal controls, ensuring compliance with GAAP, and other regulatory requirements.

- Leadership and Team Management: As a Controller, you'll likely oversee a team, so emphasize your leadership skills and your ability to inspire and manage a team effectively.

Tailoring Skills to the Job Description

While it's tempting to list every skill you possess, tailoring this section to the job you're applying for is crucial. Analyze the job description to identify the skills most valued by the employer, and ensure these are prominently featured in your resume. This alignment not only demonstrates your qualifications but also helps your resume pass through Applicant Tracking Systems (ATS) that screen for specific keywords.

Example: Skills Section for a Controller Resume

- Proficient in financial reporting, budgeting, and forecasting

- Expert in GAAP and financial regulations

- Strong analytical and strategic planning skills

- Experienced in leading and managing finance teams

- Skilled in using ERP systems (SAP, Oracle)

Soft Skills: The Underrated Assets

While the technical skills required for a Controller role are non-negotiable, soft skills are equally important. The ability to communicate complex financial information in an understandable way, negotiate with and persuade stakeholders, and adapt to rapidly changing business environments can set you apart. Highlight these skills to paint a picture of a well-rounded candidate.

Conclusion

The skills section of your Controller resume is more than just a list; it's an opportunity to demonstrate your comprehensive expertise and suitability for the role. By focusing on the skills most relevant to the position and balancing technical proficiency with essential soft skills, you position yourself as a highly attractive candidate capable of driving financial success and stability.

Elevating Your Resume with Strategic Additional Sections

For Controller positions within the Accounting & Finance sector, every section of your resume needs to contribute to an overarching narrative of competence, experience, and readiness for the challenges ahead. While the main sections of your resume cover the essentials, additional sections can provide a deeper insight into your qualifications, giving you an edge over other candidates. Here's how to leverage additional sections to make your resume stand out.

Selecting Meaningful Additional Sections

Consider what aspects of your professional and personal development are most relevant to a Controller role and how they can add value to your application. Possible additional sections include:

- Certifications: Beyond the essential CPA (Certified Public Accountant), additional certifications like CMA (Certified Management Accountant) or CGMA (Chartered Global Management Accountant) can showcase your specialized knowledge and commitment to the profession.

- Professional Memberships: Membership in professional organizations like the AICPA (American Institute of CPAs) or state-specific accounting societies demonstrates your active engagement with the accounting community.

- Volunteer Experience: Leadership or financial roles in nonprofit organizations can highlight your practical skills, leadership abilities, and commitment to community service.

- Awards and Honors: Recognitions for professional achievements or academic excellence can set you apart as a high achiever.

- Languages: Proficiency in additional languages can be a significant asset in global companies or in roles requiring interaction with international stakeholders.

Crafting Your Certifications Section

When listing certifications, include the full name of the certification, the issuing organization, and the date of certification (or expected date if you're currently pursuing it). For example:

- Certified Public Accountant (CPA), American Institute of Certified Public Accountants, 2020

- Certified Management Accountant (CMA), Institute of Management Accountants, In Progress

Professional Memberships: More Than Just a Line Item

For each professional membership, briefly mention any active roles or contributions you've made to the organization, such as committee participation or speaking at events. This can demonstrate leadership and a proactive attitude towards professional development.

Integrating Volunteer Experience

Highlight any financial management or leadership roles in volunteer capacities, focusing on the skills you developed and the impact of your contributions. For example, managing the budget for a charity event showcases your ability to oversee finances and achieve goals efficiently.

Showcasing Awards and Honors

List any relevant awards and honors with the issuing body and date. Prioritize those that are most prestigious or directly relevant to the finance and accounting field.

Including Languages

List languages in which you are proficient, especially those relevant to the company's operations or the markets it serves. Indicate your level of proficiency (basic, conversational, fluent, native).

Conclusion

By thoughtfully selecting and detailing additional sections on your resume, you offer a more complete picture of your capabilities, achievements, and the unique value you bring to a Controller position. These sections can provide compelling evidence of your qualifications, distinguishing you in a competitive job market and helping to secure your position as a top candidate.

Crafting a Compelling Cover Letter for Your Controller Application

While your resume is crucial for detailing your experience and qualifications, a cover letter provides a unique opportunity to narrate your professional story and express why you're the ideal candidate for the Controller position. This personalized document allows you to directly address the hiring manager, highlight your most relevant achievements, and demonstrate your enthusiasm for the role and the company. Here’s how to craft a cover letter that complements your resume and propels your application to the top of the pile.

Understanding the Purpose of Your Cover Letter

A cover letter should not merely repeat the details of your resume. Instead, it should provide context to your experiences, explain any gaps or unique circumstances, and specifically address how you can contribute to the company. It's your chance to make a personal connection with the employer and show that you're a well-rounded candidate.

Structure of Your Cover Letter

- Introduction: Start with a strong opening line that grabs attention. Mention the position you’re applying for and how you learned about it.

- Body Paragraphs: Here, detail your relevant experiences and achievements. Use specific examples that demonstrate your skills and how they apply to the challenges of the Controller position. Mention any direct experience with industries or systems relevant to the potential employer.

- Company-Specific Paragraph: Show that you’ve done your homework. Explain why you’re excited about the opportunity and how you align with the company’s values and goals.

- Conclusion: Reiterate your enthusiasm for the position. Thank the reader for considering your application and suggest a follow-up action, like an interview.

Tailoring Your Cover Letter

- Customize for the Job: Use the job description as a guide to tailor your cover letter. Highlight the experiences and skills that align most closely with what the employer is seeking.

- Speak to the Company’s Needs: Demonstrate your understanding of the company’s challenges and how you’re uniquely positioned to solve them.

- Be Concise: Your cover letter should be no longer than one page. Keep it focused and impactful.

Example Opening for a Controller Cover Letter

"Dear [Hiring Manager’s Name],

I am writing to express my interest in the Controller position listed on [Where You Found the Job Posting], bringing with me a decade of experience in financial management and strategic planning within fast-paced, growth-oriented environments."

Conveying Your Unique Value

Beyond technical skills and experiences, use your cover letter to share a bit about your leadership style, your approach to problem-solving, and how you manage teams or projects. These insights can provide a more comprehensive view of what you’ll bring to the role.

Conclusion

A well-crafted cover letter is a powerful tool in your job search arsenal. It allows you to speak directly to the hiring manager, highlighting your most relevant experiences and expressing your passion for the role and the company. By following these guidelines and tailoring your letter to each application, you can create a compelling narrative that showcases your suitability for the Controller position and leaves a lasting impression.

Summing Up Your Journey to Crafting the Perfect Controller Resume

Crafting a standout resume for a Controller position in the Accounting & Finance sector is a meticulous process that requires attention to detail, strategic structuring, and a deep understanding of what makes your professional story unique. From articulating a compelling summary or objective to presenting your work experience, education, skills, and beyond, each section of your resume must be carefully curated to showcase your qualifications and readiness for the challenges ahead.

The Resume Roadmap: Key Takeaways

- Professional Summary/Objective: Start strong with a clear, impactful summary or objective that highlights your key achievements and readiness for the Controller role.

- Work Experience: Transform duties into achievements, using quantifiable results to demonstrate your impact.

- Education: Detail your academic background, emphasizing degrees, certifications, and any other training relevant to the field of Accounting & Finance.

- Skills: Include both hard and soft skills, tailoring this section to match the job description and showcasing your comprehensive expertise.

- Additional Sections: Certifications, professional memberships, volunteer experience, and any other relevant sections can provide a more complete picture of your qualifications.

- Cover Letter: Complement your resume with a personalized cover letter that narrates your professional story, emphasizes your achievements, and expresses your enthusiasm for the role and the company.

Crafting a Narrative

Remember, your resume and cover letter are not just collections of experiences and skills but are narratives of your professional journey. They should tell the story of a dynamic, skilled professional ready to take on the challenges of the Controller position. Tailoring your resume to each job application, emphasizing results over responsibilities, and showcasing your continuous commitment to professional development are key strategies in making your application stand out.

Continuous Improvement

The process of resume and cover letter writing is one of continuous improvement. Seek feedback, be open to revising your approach, and stay informed about current trends in resume writing and the Accounting & Finance sector. This proactive stance will ensure that your application remains competitive and reflects your true potential as a candidate.

In sum, the path to securing a Controller position is one of strategic preparation, personal reflection, and continuous engagement with your professional development. By following these guidelines, you can craft a resume and cover letter that not only highlight your qualifications but also position you as the ideal candidate for the role.

Conclusion

As you embark on your job search journey, keep in mind that a well-crafted resume and cover letter are your primary tools for making a strong first impression. Take the time to ensure that every element of your application is polished, professional, and reflective of your unique strengths and experiences. With a clear narrative, strategic focus, and attention to detail, you'll be well on your way to securing your next role as a Controller in the dynamic field of Accounting & Finance.

Addressing Common Questions on Crafting a Controller Resume

When it comes to creating a resume for a Controller position in the Accounting & Finance sector, candidates often have specific questions about how to best present their experience, skills, and qualifications. Here are answers to some of the most frequently asked questions, designed to help you refine your resume and cover letter for your next job application.

Q1: How Long Should My Resume Be?

For a Controller position, aim for a resume length of one to two pages. If you have extensive experience relevant to the role, it's acceptable to go slightly over two pages, but ensure every detail adds value to your application.

Q2: How Can I Make My Resume Stand Out?

- Tailor Your Resume: Customize your resume for each job application, highlighting the experience and skills that align closely with the job description.

- Quantify Achievements: Use numbers and metrics to demonstrate your impact in previous roles.

- Incorporate Keywords: Include industry-specific keywords and phrases from the job listing to make your resume ATS-friendly.

- Professional Design: Use a clean, professional layout that makes your resume easy to read.

Q3: Should I Include a Photo on My Resume?

Generally, including a photo on your resume is not recommended in the Accounting & Finance sector, especially in the U.S. and other countries where anti-discrimination laws apply. Focus instead on the content of your resume to make a strong impression.

Q4: How Do I Address Employment Gaps?

Be proactive in explaining any significant gaps in your employment. Use your cover letter or an additional section in your resume to briefly explain the reason for the gap, focusing on any constructive activities during that time, such as further education, volunteer work, or freelance projects.

Q5: Can I Include Volunteer Work?

Absolutely. Volunteer work can showcase your leadership skills, commitment to community, and ability to manage projects or finances, especially if it's relevant to the Controller role.

Q6: How Important Are Certifications?

Certifications are highly valued in the Accounting & Finance sector. Relevant certifications, such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant), should be prominently featured in your resume, as they underscore your expertise and commitment to professional development.

Q7: What If I'm Transitioning From a Different Sector?

If you're transitioning from a different sector, focus on transferable skills such as financial analysis, project management, and leadership abilities. Highlight any relevant certifications, courses, or volunteer experiences that demonstrate your commitment to the Accounting & Finance sector.

Conclusion

Crafting a resume and cover letter for a Controller position is a strategic process that requires attention to detail, a deep understanding of the role and industry, and a clear presentation of your unique qualifications. By addressing these common questions and following best practices, you can create a compelling application that showcases your readiness for the challenges and opportunities of the Controller role.

Recommended Reading