In the dynamic world of banking and finance, standing out with a well-crafted resume is crucial. This sector values precision, analytical skills, and a knack for navigating complex financial landscapes. Whether you're aspiring to break into banking or aiming to climb the corporate ladder, your resume serves as your personal brochure. It's not just a summary of your experience; it's your ticket to exciting career opportunities. In this guide, we delve into the essentials of writing a resume tailored to banking jobs, arming you with the tools to showcase your expertise and accomplishments effectively. From structuring your resume to highlighting your financial acumen, we cover all you need to know to create a document that resonates with recruiters and sets you up for success.

Crafting a Winning Banking Job Resume: Real-World Examples

Liam Patterson

Senior Financial Analyst

CFA Certified

Los Angeles, CA | (555) 123-4567

liam.patterson@email.com | LinkedIn: linkedin.com/in/liampatterson

PROFESSIONAL SUMMARY

Analytical and detail-oriented Senior Financial Analyst with over 8 years of experience in financial modeling, risk assessment, and strategic planning. Proven track record in optimizing financial performance and enhancing operational efficiencies within the banking sector. Holds a CFA certification and excels in leveraging data analytics to inform financial decision-making and strategy.

WORK EXPERIENCE

Senior Financial Analyst

Wells Fargo, Los Angeles, CA

July 2016 – Present

- Lead a team of analysts in developing complex financial models to evaluate investment opportunities, resulting in a 20% increase in profitable investments.

- Conduct thorough market analysis to guide the strategic planning process, identifying key trends and opportunities for growth.

- Collaborate with cross-functional teams to design and implement financial solutions that support business objectives, improving operational efficiency by 15%.

Financial Analyst

Bank of America, Los Angeles, CA

May 2012 – June 2016

- Assisted in the preparation of quarterly financial statements and reports, ensuring compliance with regulatory standards.

- Played a key role in the budgeting and forecasting process, achieving a 98% accuracy rate in financial forecasts.

- Developed and maintained financial databases and models, improving data accuracy and accessibility for the team.

EDUCATION

Master of Science in Finance

University of Southern California

Los Angeles, CA

Graduated: June 2012

Bachelor of Science in Economics

University of California

Berkeley, CA

Graduated: June 2010

CERTIFICATIONS

Chartered Financial Analyst (CFA)

- CFA Institute, August 2014

SKILLS

- Financial Modeling & Analysis

- Strategic Planning & Risk Management

- Budgeting & Forecasting

- Data Analytics & Business Intelligence Tools

- Regulatory Compliance & Reporting

- Team Leadership & Collaboration

PROFESSIONAL AFFILIATIONS

- CFA Institute Member

- Association for Financial Professionals (AFP)

LANGUAGES

- English (Native)

- Chinese (Fluent)

Fine-Tuning Your Resume Format for the Banking Sector

Crafting a resume for a banking job requires more than listing your experiences and education; it's about presenting your credentials in the most effective way possible. The format of your resume plays a crucial role in highlighting your strengths and drawing the recruiter’s attention to your most valuable assets. Here's how to structure your resume for success in the banking and finance sector:

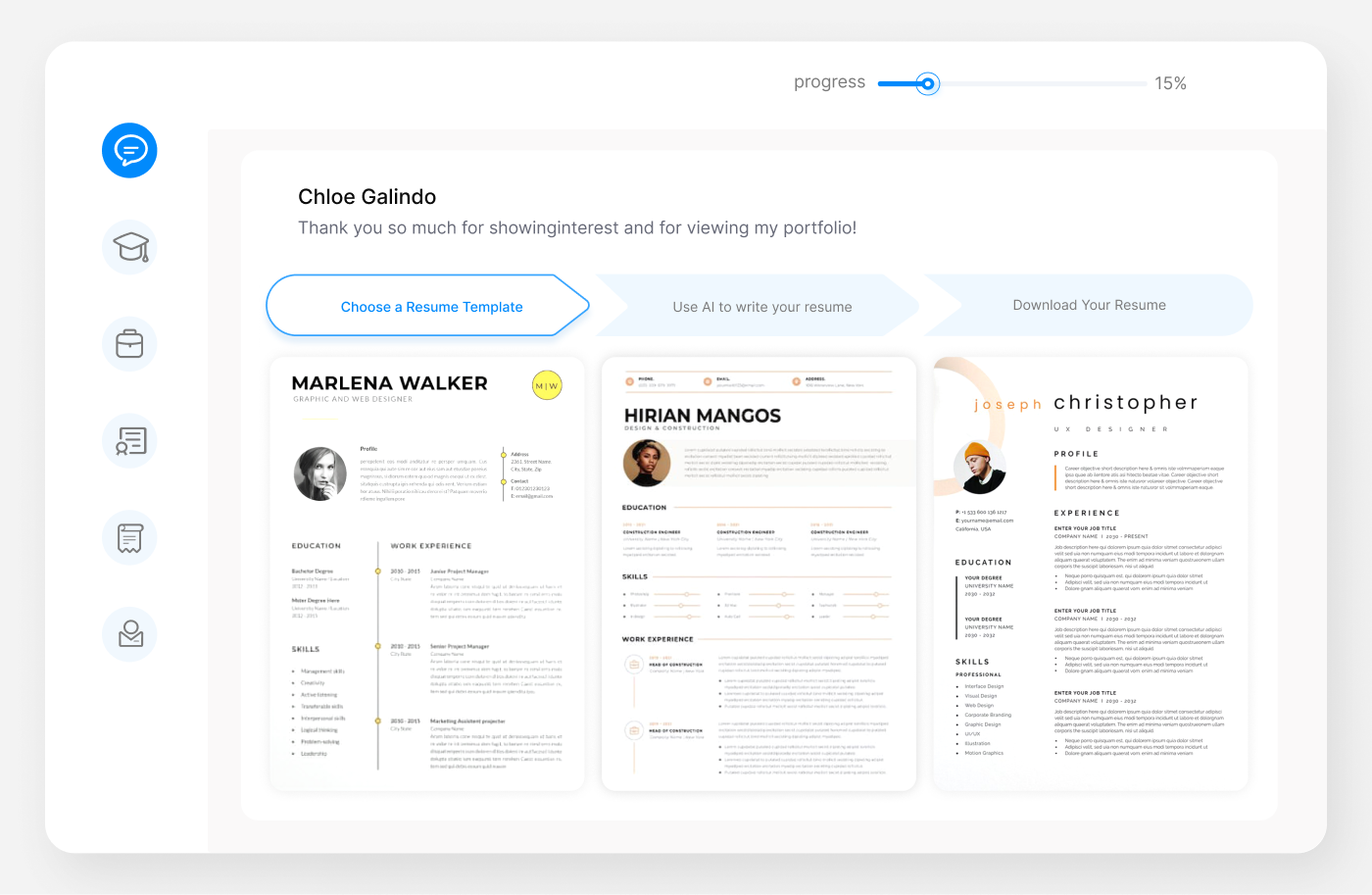

1. Choosing the Right Resume Format

There are three main resume formats: chronological, functional, and hybrid. For most banking professionals, the chronological format is preferable because it showcases a steady career progression. However, if you're changing careers or have significant gaps in your employment, a hybrid format can help you highlight your relevant skills alongside your work history.

2. Optimal Resume Length

Keep your resume concise and impactful. For entry-level candidates, a one-page resume is ideal. Experienced professionals can extend to two pages, but every word should contribute value to your candidacy.

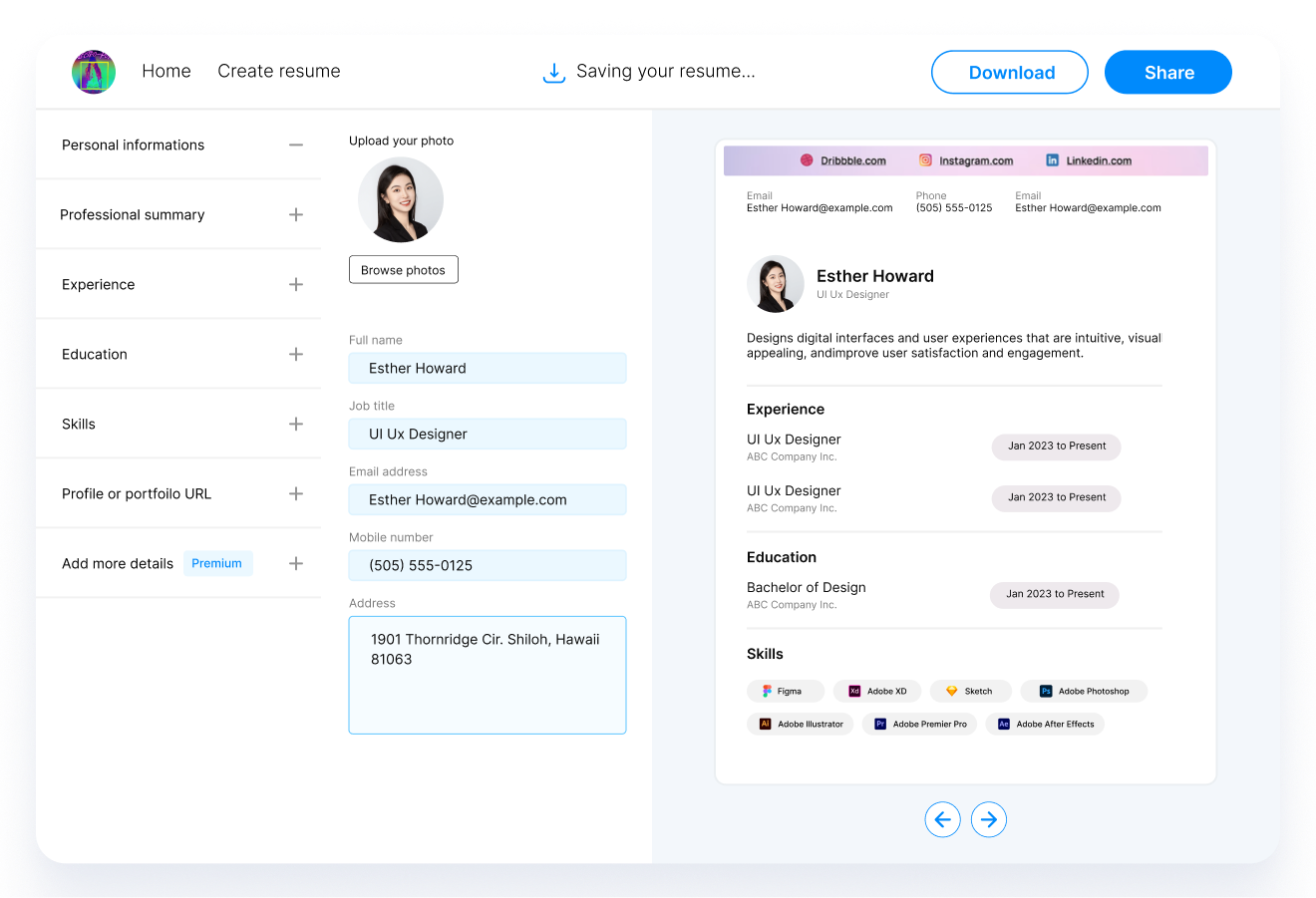

3. Effective Use of Headers and Sub-Headers

Use clear, distinguishable headers to organize your resume into sections such as Professional Summary, Work Experience, Education, and Skills. This makes your resume easy to scan and ensures that recruiters can quickly find the information they’re interested in.

4. Bullet Points for Clarity

Use bullet points to list your responsibilities and achievements in each role. This format makes your resume easier to read and allows you to highlight specific accomplishments, such as "Increased portfolio value by 20% through strategic investment decisions."

5. Quantifying Achievements

Whenever possible, quantify your achievements with numbers, percentages, or other measures to provide concrete evidence of your contributions and successes.

6. Tailoring Your Resume

Customize your resume for each job application, emphasizing the experience and skills most relevant to the position. Use keywords from the job description to pass through Applicant Tracking Systems (ATS) and catch the eye of the recruiter.

7. Professional Aesthetics

Choose a professional, clean resume design with sufficient white space and a standard font. This professionalism is crucial in the banking sector, where attention to detail and a conservative approach are valued.

8. Contact Information

Ensure your contact information is up-to-date and professional. Use a personal email address that includes your name, and avoid unprofessional handles.

Crafting a Captivating Resume Summary or Objective for Banking Professionals

In the competitive banking industry, the first few lines of your resume can set the tone for the rest of your application. A compelling resume summary or objective is crucial for making a strong first impression. This section should concisely highlight your most significant achievements, skills, and career aspirations, tailored to the banking job you’re applying for.

Crafting an Engaging Resume Summary

The resume summary is ideal for experienced banking professionals. It should encapsulate your years of experience, key skills, and major accomplishments. Here's how to make it stand out:

- Start with your title and years of experience.

- Highlight your key banking skills, focusing on those most relevant to the job listing.

- Mention one or two major achievements, using numbers to quantify your success.

- Customize it for each job application to align with the employer’s needs.

Resume Summary Example for a Banking Professional:

Seasoned Banking Manager with over 10 years of experience in enhancing operational efficiency and maximizing profits. Expert in developing and implementing financial strategies, risk management, and fostering client relationships. Successfully led a team to achieve a 30% revenue increase in two years through strategic investment planning and client portfolio expansion.

Writing a Persuasive Resume Objective

The resume objective is more suitable for those new to the banking field or professionals aiming to switch careers. It focuses on your career goals and how you can contribute to the prospective employer:

- Clearly state your career objectives and how they align with the company’s goals.

- Emphasize your transferable skills and how they can benefit the banking role you’re applying for.

- Be specific about the banking position you’re seeking and why you’re interested in it.

Resume Objective Example for an Aspiring Banking Professional:

Driven and detail-oriented professional seeking to leverage a background in financial analysis and a Master’s in Finance to transition into the banking sector as a Junior Financial Analyst. Eager to apply analytical skills and a keen understanding of financial markets to contribute to the strategic goals of ABC Bank.

Whether you choose a summary or an objective, ensure it's tailored to the role and showcases your unique value proposition. This brief but powerful introduction is your first opportunity to capture the hiring manager's attention and differentiate yourself from other candidates.

Highlighting Your Work Experience in the Banking Sector

The Work Experience section is the backbone of your resume, showcasing your career achievements and growth. In the banking industry, where precision and reliability are paramount, how you present your past roles can significantly impact your job application’s success. Here are strategies to ensure your work experience stands out:

Structure and Detail

- Use Reverse Chronological Order: Start with your most recent job and work backwards. This format highlights your progression and recent accomplishments in the banking sector.

- Be Specific About Your Role and Responsibilities: Clearly define your position and outline your duties. Use action verbs to convey your contributions effectively.

- Managed a portfolio of 100+ high-net-worth clients, developing personalized investment strategies that resulted in an average of 15% ROI per client.

Quantifying Achievements

Quantifying your achievements with numbers, percentages, or financial figures adds credibility to your claims and illustrates the tangible impact you’ve had in previous roles.

Quantify Your Impact:

- Increased loan portfolio by 20% through strategic relationship building and targeted product offers.

Highlighting Relevant Skills and Knowledge

Tailor your work experience to the job by emphasizing the skills and experiences most relevant to the banking position you’re applying for. Highlight your understanding of financial regulations, risk management, or client relationship skills as appropriate.

Demonstrating Continual Learning and Adaptation

The banking sector is continually evolving, so showcasing your ability to adapt and stay current with industry trends and regulations is crucial.

- Led a team through a comprehensive digital transformation, implementing new financial software that improved operational efficiency by 30%.

Using Professional Language

Maintain a professional tone throughout your resume. Use industry-specific jargon where appropriate, but ensure it’s accessible to non-specialist HR staff who may initially screen your resume.

Avoiding Common Pitfalls

- Don’t Be Vague: Be as specific as possible about your roles, responsibilities, and achievements.

- Avoid Repetition: Each bullet point should highlight a new skill or achievement.

- Keep It Relevant: While it’s tempting to list all your experiences, focus on the most relevant ones to the banking job you’re applying for.

Showcasing Your Educational Background for Banking Roles

In the banking sector, your educational background can significantly bolster your resume, especially if it aligns with finance, economics, or a related field. Here's how to effectively present your education in a way that supports your candidacy for banking jobs:

Prioritize Relevant Education

- List your highest degree first, followed by others in reverse chronological order.

- Include the degree type, your major, and the name and location of the educational institution.

- Mention your graduation year if it’s within the last five years to avoid dating your resume unnecessarily.

Highlighting Accomplishments and Relevant Coursework

- Include honors, awards, or a high GPA if applicable, as these can set you apart from other candidates.

- List relevant coursework or projects if they demonstrate skills or knowledge applicable to the banking position you’re applying for.

Bachelor of Science in Finance – Magna Cum Laude

University of Pennsylvania, Philadelphia, PA

Graduated: May 2018

- Relevant Coursework:

- Financial Accounting,

- Investment Banking,

- Risk Management

Including Certifications and Continuing Education

Banking is a field that values certifications and ongoing learning. Including relevant certifications or courses can greatly enhance your resume:

- Certifications: List any industry-relevant certifications, such as CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant), that you have earned.

- Continuing Education: Include any additional courses or workshops you’ve completed that are relevant to banking and finance.

Certifications:

Chartered Financial Analyst (CFA), CFA Institute

– August 2020

Customizing the Education Section for Your Experience Level

- For recent graduates, your education section can be more detailed, including information on relevant projects, extracurricular activities, and coursework.

- Experienced professionals should focus on degrees and certifications, keeping this section concise to prioritize work experience.

Do’s and Don’ts for the Education Section

Do:

- Include any scholarships, awards, or honors.

- List education that is directly relevant to the banking sector.

- Mention leadership roles in academic or student organizations.

Don’t:

- Include high school education if you have completed a college degree.

- List every course you’ve taken; focus on those most relevant to banking.

- Overcrowd this section at the expense of more relevant work experience.

Your education is a testament to your foundational knowledge and skills in banking and finance. Presenting it effectively can enhance your resume, especially if you’re able to draw clear connections between your academic background and the requirements of the banking role you’re applying for.

Essential Skills for a Standout Banking Resume

In the competitive landscape of banking and finance, highlighting your skills is crucial to setting yourself apart from other candidates. The "Skills" section of your resume should be a blend of hard technical skills and soft skills that demonstrate your capability to excel in a banking environment. Here's how to effectively showcase your skills:

Hard Skills: The Technical Backbone

- Financial Analysis & Modeling: Proficiency in analyzing financial statements and creating models for decision-making is vital.

- Regulatory Compliance: Understanding of laws and regulations governing the banking sector is essential.

- Risk Management: Skills in identifying, assessing, and mitigating financial risks are highly valued.

- Software Proficiency: Familiarity with financial software (e.g., Bloomberg Terminal, SAP) and advanced Excel skills.

Highlight Technical Proficiency:

- Expert in financial modeling using Excel and proprietary software.

- Comprehensive knowledge of SEC regulations and compliance requirements.

Soft Skills: The Interpersonal Element

- Communication: Ability to convey complex financial information clearly and persuasively.

- Problem-Solving: Skills in identifying issues and implementing effective solutions.

- Attention to Detail: Precision in financial reporting and analysis.

- Leadership: Experience leading teams and managing projects to successful completion.

Demonstrate Interpersonal Effectiveness:

- Recognized for excellent communication skills, presenting complex financial data to non-experts.

- Proven leadership in guiding teams through challenging financial projects.

Customizing Skills for the Job

Review the job posting carefully and identify the skills emphasized by the employer. Tailor your resume to include these skills, using the exact wording from the job description when possible. This customization makes your resume more attractive to both hiring managers and Applicant Tracking Systems (ATS) that may screen your application.

Balancing the Mix

While it's important to showcase a strong set of technical skills, don't underestimate the power of soft skills. The banking industry values professionals who are not only technically proficient but also able to navigate the complexities of client relations and team management.

Continuous Learning

Mention any ongoing or recent professional development efforts, such as courses or certifications in new financial software or methodologies. This demonstrates your commitment to staying current in a rapidly evolving field.

Elevating Your Banking Resume with Additional Sections

To truly stand out in the banking job market, consider adding sections to your resume that go beyond the standard expectations. These additional sections can showcase your unique qualifications and experiences, further distinguishing you from other candidates. Here's how to strategically use additional sections in your banking resume:

Certifications

Certifications relevant to the banking industry can greatly enhance your resume. Include any credentials that demonstrate your expertise and commitment to the field, such as Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), or Financial Risk Manager (FRM).

Certifications Section Example:

- Chartered Financial Analyst (CFA), CFA Institute

- Certified Public Accountant (CPA), American Institute of CPAs

Awards and Honors

If you've received any awards or honors that highlight your achievements in banking or finance, including them can add a layer of prestige to your resume. This might include industry awards, performance recognitions, or academic honors.

Volunteer Experience

Volunteer experiences, especially those related to finance or community service, can illustrate your commitment to using your skills for a greater good. They also demonstrate a well-rounded character, an aspect highly regarded in client-facing roles.

Volunteer Experience Section Example:

- Volunteer Financial Advisor, Non-Profit Financial Literacy Program

- Treasurer, Local Community Service Organization

Professional Affiliations

Membership in professional organizations reflects your active engagement with the banking and finance community. It can also indicate your access to current industry insights and professional development opportunities.

Projects

Highlighting specific projects, particularly those that had a significant impact or demonstrate innovative solutions, can be very effective. This is especially relevant for candidates who have led noteworthy initiatives or participated in cutting-edge research.

Projects Section Example:

- Led a team in developing a new predictive model for credit risk assessment, which reduced loan defaults by 15%.

Languages

Fluency in additional languages can be a significant asset in global banking operations or in areas with a diverse client base. Include any languages you speak along with your proficiency level.

By incorporating these additional sections into your banking resume, you not only provide a more comprehensive view of your professional landscape but also highlight the diverse range of your skills and experiences. Tailor these sections to reflect the requirements of the job you're applying for, ensuring they add value and relevance to your application.

Mastering the Art of the Cover Letter for Banking Jobs

When applying for banking positions, a well-crafted cover letter can be as crucial as your resume. It's your chance to narrate your professional story, demonstrating how your skills, experiences, and ambitions align with the role and the organization's goals. Here's how to write a compelling cover letter for the banking sector:

Personalize Your Introduction

Start by addressing the hiring manager by name whenever possible. A personalized greeting shows that you've taken the time to research the company.

Express Your Enthusiasm

Convey your genuine interest in the banking sector and the specific institution. Highlight how your career goals align with the company’s mission and values.

Highlight Key Achievements

Choose two or three significant accomplishments from your resume that demonstrate your suitability for the job. Use specific examples and quantify your achievements to add credibility.

Demonstrate Industry Knowledge

Show that you're up to date with the latest trends and challenges in the banking industry. Briefly discuss how your skills can help address these challenges or contribute to the company’s objectives.

Address the Requirements

Refer to the job listing and speak directly to the qualifications and responsibilities mentioned. Explain how your background makes you the ideal candidate for these specific requirements.

Close with a Call to Action

End your letter by thanking the reader for considering your application and expressing your eagerness to discuss how you can contribute to their team. Propose the next step, such as an interview, and indicate that you're looking forward to their response.

Keep It Professional and Concise

Your cover letter should be no longer than one page. Use a professional tone throughout, and proofread carefully to avoid any typos or grammatical errors.

A cover letter for a banking job is not just a formality; it's an opportunity to stand out from other candidates by adding depth to your application and personalizing your pitch. By following these guidelines, you can craft a cover letter that captures the attention of hiring managers and moves you one step closer to securing your desired position in the banking industry.

Concluding Insights: Elevating Your Banking Resume to the Next Level

In the competitive realm of banking and finance, your resume and cover letter are more than just paperwork; they are your personal marketing tools. Crafting these documents with precision, relevance, and strategic insight can significantly elevate your job application, setting you apart from a sea of candidates. Here are some key takeaways to remember as you refine your banking resume and embark on your job search journey:

- Tailor Your Application: Customize your resume and cover letter for each job application, highlighting the skills and experiences most relevant to the position.

- Quantify Achievements: Wherever possible, use numbers and metrics to quantify your successes, lending credibility and depth to your accomplishments.

- Highlight Soft Skills: In addition to technical skills, emphasize your communication, leadership, and problem-solving abilities, showcasing your well-roundedness as a candidate.

- Continuous Learning: Demonstrate your commitment to professional growth by including recent certifications, courses, or participation in industry events.

- Professional Presentation: Ensure that your resume and cover letter are meticulously formatted, error-free, and professional in tone and appearance.

- Follow Application Instructions: Pay close attention to the application requirements for each job posting and follow instructions carefully to avoid disqualification.

- Prepare for the Next Steps: Anticipate the interview stage by preparing thoughtful questions about the role and the company and by rehearsing your responses to common banking interview questions.

The banking sector offers a dynamic and rewarding career path for those who navigate the application process with strategy and intention. By leveraging these insights and dedicating the time to craft compelling, customized application materials, you position yourself not just as a qualified candidate, but as a standout professional poised to make a significant impact in the world of banking.

Frequently Asked Questions: Crafting the Perfect Banking Resume

When embarking on the journey to craft the perfect resume for a banking job, candidates often encounter a myriad of questions. The banking industry's competitive nature and high standards require a resume that not only meets basic requirements but also stands out. Below are some common questions and their answers to guide you in creating an effective banking resume:

How long should my banking resume be?

For most candidates, a one-page resume is ideal, especially for entry-level positions. Experienced professionals with extensive banking careers can extend to two pages if necessary, but it's crucial to keep the content relevant and concise.

Should I include a photo on my banking resume?

In most cases, including a photo on your resume is not recommended, especially in the banking sector. Focus on your skills, experiences, and achievements rather than personal attributes.

How can I make my resume stand out to recruiters?

Tailor your resume for each application, highlighting the skills and experiences most relevant to the job. Use quantifiable achievements to demonstrate your success, and ensure your resume is well-organized and professionally formatted.

What if I don't have direct experience in banking?

Highlight transferable skills and experiences that are relevant to the banking sector, such as analytical abilities, customer service experience, or proficiency in financial software. Consider including internships, volunteer work, or coursework that demonstrate your interest and competency in finance.

Can I use a creative resume design for a banking job?

While it's important for your resume to be visually appealing, it's crucial to maintain professionalism. Opt for a clean, classic design that emphasizes readability and professionalism over creativity, especially for roles in traditional banking institutions.

How important are keywords in a banking resume?

Very important. Many banking institutions use Applicant Tracking Systems (ATS) to screen resumes, so including relevant keywords from the job description can ensure your resume passes through the initial screening.

How do I address employment gaps in my resume?

Be honest about employment gaps, and if possible, fill them with relevant activities such as further education, freelance work, or volunteering. Focus on the skills and knowledge gained during these periods.

Is it necessary to include a cover letter with my banking resume?

Yes, a cover letter is a critical component of your application. It offers the opportunity to further explain your qualifications and interest in the position, providing context and personality beyond the resume.

Crafting a resume for a banking job requires careful consideration and strategic presentation of your qualifications. By addressing these common concerns, you can create a resume that effectively communicates your value as a candidate and positions you for success in the competitive banking industry.

Recommended Reading