From understanding the importance of accuracy and attention to detail in financial transactions to showcasing your ability to manage and reconcile accounts efficiently, your resume should reflect your proficiency in the critical functions of accounts payable and receivable. Moreover, in a sector where the landscape is continually evolving, staying abreast of the latest technological advancements and financial regulations is paramount. This guide will provide you with actionable advice and real-life examples to enhance your resume, making it a powerful tool in your job search arsenal. Let's dive into how you can craft a resume that stands out, engages hiring managers, and opens doors to new opportunities in the accounting and finance sector.

Accounts Payable/Receivable Specialist Resume Example

Samantha Greene

4352 Finance Lane, Minneapolis, MN 55403

(612) 555-0198 | samantha.greene@email.com

LinkedIn: linkedin.com/in/samanthagreene

Professional Summary

Detail-oriented Accounts Payable/Receivable Specialist with over 5 years of experience in fast-paced finance departments. Adept at processing high volumes of invoice transactions, maintaining accurate records, and resolving account discrepancies. Proven track record of improving payment cycles and optimizing financial operations. Skilled in leveraging finance software and analytical tools to streamline processes, enhance productivity, and ensure compliance with financial policies and regulations.

Professional Experience

Accounts Payable/Receivable Specialist

Delta Financial Services

Minneapolis, MN | July 2019 – Present

- Process an average of 500+ invoice transactions monthly, ensuring accurate payment and revenue recording.

- Spearheaded the implementation of a new electronic payment system, reducing processing time by 30%.

- Collaborate with vendors and internal departments to reconcile account discrepancies, resulting in a 25% decrease in overdue payments.

- Prepare detailed financial reports and forecasts, aiding in strategic planning and budget management.

Accounts Receivable Clerk

Greenwood Solutions

St. Paul, MN | May 2017 – June 2019

- Managed and monitored client accounts for a portfolio of 200+ clients, ensuring timely collections and reducing delinquencies by 20%.

- Implemented an automated billing system that improved invoice accuracy and customer satisfaction.

- Conducted monthly reconciliation of client accounts against general ledger, ensuring 100% accuracy.

- Assisted with month-end and year-end close processes, including audit support and financial analysis.

Education

Bachelor of Science in Accounting

University of Minnesota

Minneapolis, MN | Graduated May 2017

Skills

- Expertise in accounting software, including

- QuickBooks,

- SAP,

- and Oracle

- Strong analytical and problem-solving abilities

- Excellent communication and interpersonal skills

- Proficient in Microsoft Office Suite, with a focus on Excel

- Deep understanding of financial regulations and accounting principles

Certifications

- Certified Accounts Payable Professional (CAPP) | 2018

- Certified Accounts Receivable Professional (CARP) | 2019

Crafting a Winning Resume Layout for Finance Professionals

When it comes to designing a resume for accounts payable and receivable positions, the structure and format play pivotal roles in ensuring your skills and experience are clearly and effectively showcased. A well-organized resume not only highlights your professional achievements but also makes it easier for hiring managers to identify your potential as the right candidate for the role. Here's how you can structure your resume to stand out in the finance sector:

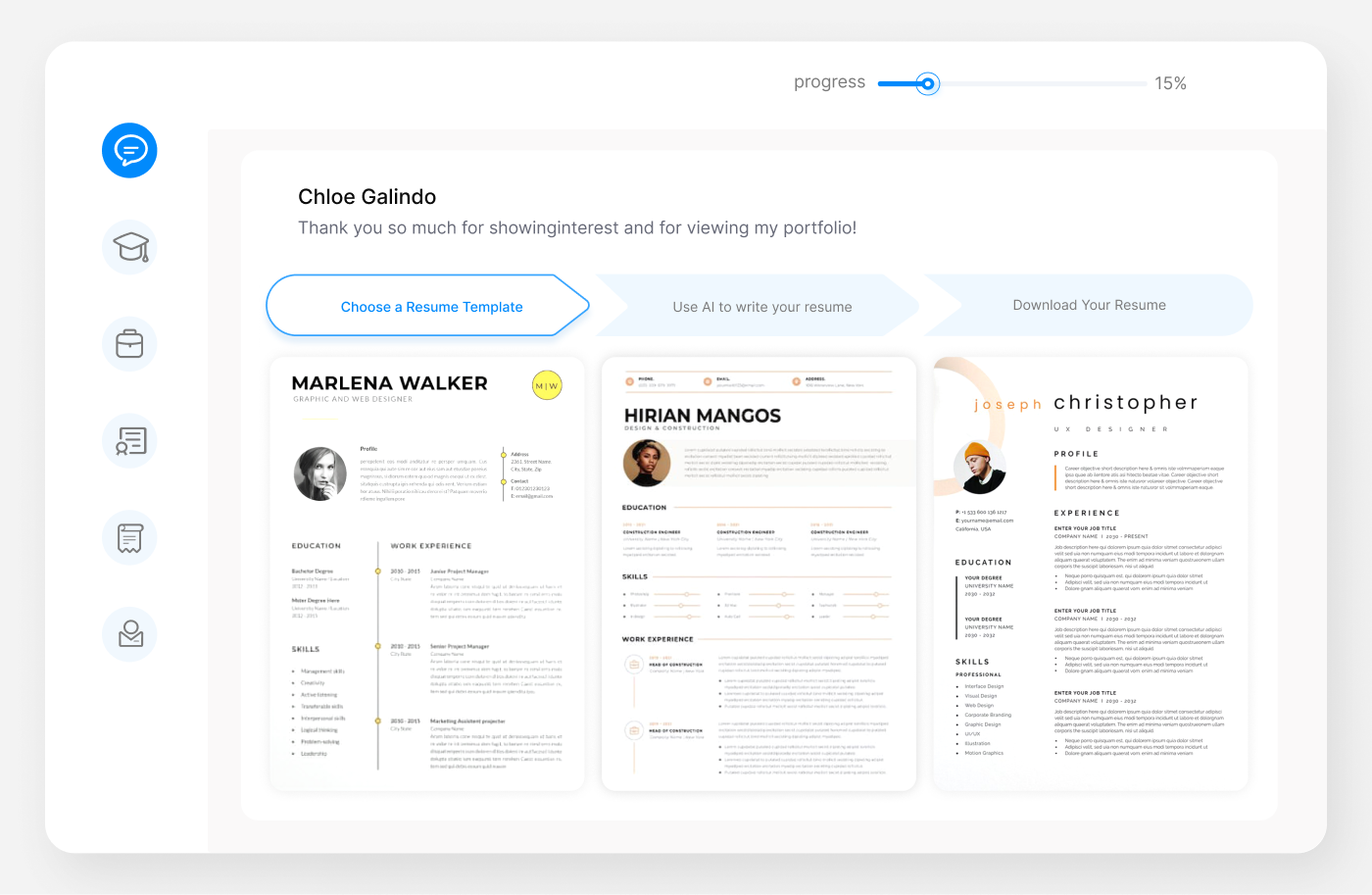

Choose the Right Resume Format

Selecting the appropriate resume format is crucial in presenting your experience and skills in the best light. The three main types of resume formats are chronological, functional, and combination. For most accounts payable/receivable professionals, a chronological format is often recommended as it focuses on your work history, showcasing your progression and achievements in the finance field. However, if you're changing careers or have significant gaps in your employment, a functional or combination resume might better serve your needs by highlighting your skills and less on the timeline of your work history.

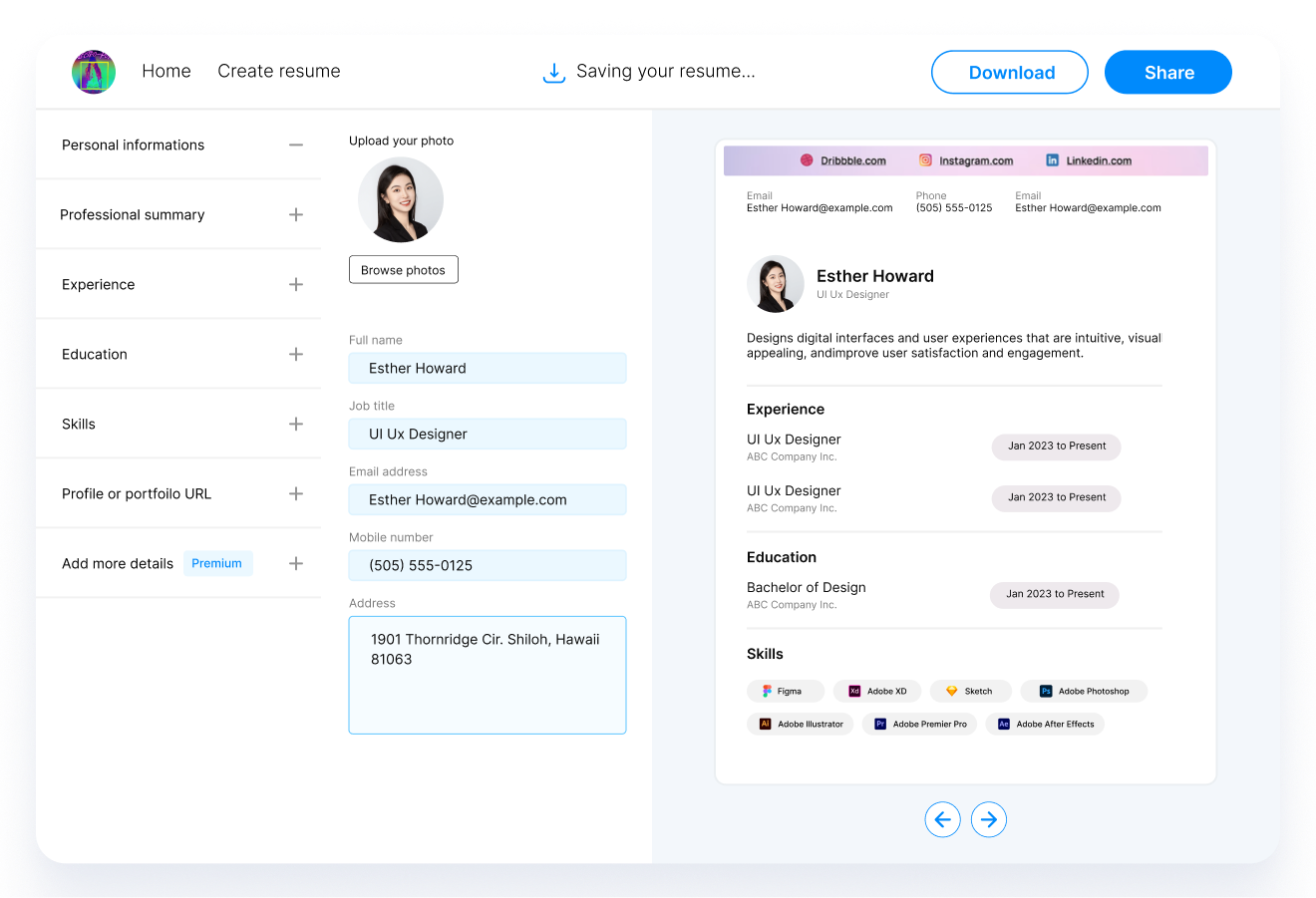

Essential Resume Sections

Your resume should include the following key sections to provide a comprehensive overview of your qualifications:

- Contact Information: Include your name, phone number, email, and LinkedIn profile to make it easy for employers to reach you.

- Professional Summary or Objective: A brief section that summarizes your experience, achievements, and career goals. Tailor this to the specific accounts payable/receivable role you're applying for.

- Work Experience: List your previous roles in reverse chronological order. Focus on quantifiable achievements and responsibilities that align with the accounts payable/receivable domain.

- Education: Detail your academic background, including degrees, certifications, and relevant courses.

- Skills: Highlight your finance-specific skills, such as proficiency with accounting software, data analysis, and financial reporting. Also, include soft skills like communication and problem-solving abilities.

- Additional Sections: Consider adding sections for certifications, professional memberships, or volunteer work, especially if they're relevant to the finance industry.

Formatting Tips

- Readability: Use a clean, professional font and ensure there's enough white space. Bullet points can help break down information and make your resume more skimmable.

- Consistency: Keep your formatting consistent throughout the document. This includes font sizes, headings, and bullet styles.

- Keywords: Incorporate industry-specific keywords and phrases found in the job listing. This can help your resume get past Applicant Tracking Systems (ATS) and catch the eye of the hiring manager.

Elevating Your Resume with a Powerful Summary or Objective

Creating a compelling resume summary or objective is pivotal for accounts payable/receivable professionals aiming to make a strong first impression. This section sits at the top of your resume, offering a snapshot of your skills, experiences, and career aspirations. It's your chance to grab the employer's attention and convey why you're the ideal candidate for the position.

Crafting a Captivating Resume Summary

A resume summary is perfect for those with a wealth of experience in accounts payable or receivable roles. It should succinctly highlight your years of experience, key achievements, and the skills that make you stand out. Focus on quantifiable successes and how you can bring value to the potential employer. For example, mention any specific projects where you optimized payment processes or significantly improved financial reporting accuracy.

Writing an Engaging Resume Objective

For those entering the field or looking to switch careers, a resume objective can be highly effective. This section should detail your career goals and how they align with the position, emphasizing your transferable skills and eagerness to learn and grow in the role. Although you might have less direct experience, highlighting your commitment and relevant skills can make a powerful impact.

Tips for Writing Your Summary or Objective

- Tailor It: Customize this section for each application, focusing on the specific requirements of the job and how your background fits.

- Be Specific: Use concrete examples and numbers to demonstrate your achievements and impact.

- Keep It Concise: Aim for 3-4 sentences that pack a punch. You want to be memorable and compelling without overwhelming the reader with information.

- Show Enthusiasm: Especially in an objective, convey your enthusiasm for the role and the accounting and finance field.

By effectively leveraging a resume summary or objective, you set the stage for the rest of your resume, positioning yourself as a promising candidate from the start.

Showcasing Work Experience: A Guide for Accounts Payable/Receivable Professionals

The Work Experience section is the cornerstone of your resume, providing a detailed look at your career journey. For accounts payable and receivable professionals, it's not just about listing job titles and duties. It's about illustrating your impact, showcasing your skills, and demonstrating how you've contributed to your past employers' success. Here's how to make your work experience resonate with potential employers:

Highlighting Your Achievements

- Quantify Your Impact: Use numbers to make your accomplishments stand out. For instance, "Managed accounts receivable for 200+ clients, reducing delinquency rates by 15% within six months."

- Detail Process Improvements: Show how you streamlined operations or implemented systems that enhanced efficiency. Example: "Introduced an automated invoicing system, cutting processing time by 30%."

- Showcase Your Technical Skills: Mention your proficiency with specific accounting software or tools that are relevant to the role you're applying for.

Tailoring Your Experience

- Match the Job Description: Align your listed experiences with the skills and duties highlighted in the job posting. If the role calls for expertise in a specific area (e.g., invoice reconciliation), ensure those experiences are prominently featured.

- Use Relevant Keywords: Incorporate industry-specific keywords throughout your work experience section. This not only makes your resume more compelling to hiring managers but also helps it pass through Applicant Tracking Systems (ATS).

Structuring Your Entries

- Use Reverse Chronological Order: Start with your most recent position and work backward. This format is preferred as it showcases your most relevant and up-to-date experience first.

- Be Clear and Concise: For each position, include your job title, the company name, and the period of employment. Bullet points are excellent for detailing your responsibilities and achievements, keeping your entries readable and to the point.

Examples of Effective Work Experience Entries

Accounts Receivable Specialist

Hawthorne Finance, Denver, CO

March 2018 – Present

- Managed and reconciled accounts for a portfolio of over 300 clients, improving overall collection times by 20%.

- Developed a comprehensive monthly reporting system that reduced financial discrepancies by 25%.

- Led training sessions for new staff on accounting software and internal protocols, enhancing team productivity by 15%.

Crafting an Education Section That Stands Out in Finance

For aspiring accounts payable/receivable professionals, the Education section of your resume provides a foundation for your expertise and knowledge in the field. While your work experience demonstrates practical skills, your educational background can highlight your dedication to the finance and accounting profession. Here’s how to effectively present your education to make a strong impact on potential employers.

Prioritize Your Most Relevant Qualifications

- List Your Degrees: Start with your highest degree and work backward. Include the degree type, your major, the name of the institution, and your graduation year. If you have a degree in finance, accounting, or a related field, make sure it's prominently displayed.

- Highlight Relevant Coursework: If you're a recent graduate or have courses directly applicable to the accounts payable/receivable role, listing these can add depth to your resume. For instance, courses in financial accounting, business law, or software applications in finance can showcase your relevant educational background.

Including Certifications and Continuous Education

- Certifications: Certifications can significantly bolster your resume, especially in a specialized field like accounting. Relevant certifications for accounts payable/receivable professionals may include Certified Accounts Payable Associate (CAPA), Certified Accounts Payable Professional (CAPP), or Certified Bookkeeper (CB). List any that you've obtained, along with the issuing organization and the date of certification.

- Workshops and Seminars: Participation in industry-specific workshops or seminars demonstrates your commitment to ongoing learning and professional development. If you've attended any that are particularly relevant to your desired role, include them in this section.

Example of an Education Section for an Accounts Payable/Receivable Resume

Bachelor of Science in Accounting

University of Colorado

Boulder, CO | Graduated May 2020

Relevant Coursework:

- Advanced Financial Accounting,

- Business Law,

- Data Analysis for Accounting

Certified Accounts Payable Professional (CAPP)

Institute of Finance & Management

Obtained June 2021

Continuing Education:

- "Advanced Excel for Finance Professionals" Workshop

- Denver Finance Institute, August 2021

- "Regulatory Compliance in Accounting" Seminar

- American Accounting Association, November 2021

Your Education section should not only list your qualifications but also convey a narrative of ongoing growth and specialization. By strategically organizing this section, you demonstrate to employers not just where you've been, but also your dedication to advancing in the accounts payable/receivable domain.

Highlighting Essential Skills for Accounts Payable/Receivable Roles

In the dynamic field of finance, possessing a strong set of skills is crucial for success in accounts payable and receivable positions. This section of your resume gives you the opportunity to showcase both your technical prowess and soft skills that are vital for the role. Let’s delve into how to effectively highlight these skills to stand out to potential employers.

Technical Skills

- Accounting Software Proficiency: Mention specific platforms you’re skilled in, such as QuickBooks, SAP, Oracle Financials, or Microsoft Dynamics. Demonstrating familiarity with these tools can significantly boost your resume.

- Financial Reconciliation: Highlight your ability to perform account reconciliations efficiently, a core responsibility in accounts payable/receivable roles.

- Data Analysis: Showcase your skills in analyzing financial data to identify trends, discrepancies, and opportunities for process improvement.

- Regulatory Knowledge: Understanding of financial regulations and compliance standards is essential. Mention any specific regulations you’re familiar with, such as GAAP or SOX compliance.

Soft Skills

- Attention to Detail: Emphasize your meticulousness in handling financial documents and records, crucial for minimizing errors in accounting processes.

- Communication Skills: Ability to communicate effectively with vendors, clients, and internal teams is key. Highlight experiences that demonstrate your communication prowess.

- Problem-Solving: Showcase instances where you used your analytical skills to resolve discrepancies or improve financial operations.

- Time Management: Accounts payable/receivable professionals often juggle multiple tasks and deadlines. Highlight your ability to manage time efficiently and prioritize tasks.

Crafting Your Skills Section

Organize your skills into bullet points for easy readability. Consider separating technical skills from soft skills to provide a clear snapshot of your capabilities. Tailor this section to the job description, focusing on the skills most relevant to the role you’re applying for.

Example Skills Section for an Accounts Payable/Receivable Resume

Technical Skills:

- Proficient in

- QuickBooks,

- SAP,

- and Oracle Financials

- Skilled in financial reconciliation and data analysis

- Experienced in managing vendor accounts and payment processing

- Familiar with GAAP and SOX financial regulations

Soft Skills:

- Exceptional attention to detail and accuracy

- Strong verbal and written communication abilities

- Proven problem-solving skills with a focus on process improvement

- Effective time management and organizational skills

By effectively highlighting your skills, you provide potential employers with a concise overview of your qualifications, making it clear why you are the ideal candidate for the accounts payable/receivable position.

Adding Value with Additional Sections on Your Finance Resume

When crafting a resume for accounts payable/receivable roles, including additional sections can significantly enhance your profile by showcasing a more comprehensive view of your capabilities and experiences. These sections can highlight certifications, awards, volunteer work, or any other achievements relevant to the field of finance. Let’s explore how to effectively integrate these into your resume.

Certifications

In the finance industry, certifications can set you apart from other candidates. If you have certifications like Certified Accounts Payable Professional (CAPP) or Certified Accounts Receivable Professional (CARP), include a section for these. Detail the certification name, the issuing organization, and the date of achievement.

Awards and Honors

Any awards or recognitions received for your work in finance or accounting should be noted. Whether it’s an Employee of the Month award or an industry-specific accolade, these can demonstrate your dedication and skill in your field.

Volunteer Experience

Volunteer work, especially if it involves financial management or accounting services for non-profits, can be a valuable addition. It shows your willingness to apply your skills in different settings and your commitment to giving back to the community.

Professional Memberships

Membership in professional organizations, like the American Institute of CPAs (AICPA) or the Institute of Management Accountants (IMA), indicates your engagement with the finance community and your commitment to staying informed about industry trends and standards.

Example of an Additional Sections for an Accounts Payable/Receivable Resume

Certifications:

- Certified Accounts Payable Professional (CAPP)

- Institute of Finance & Management, 2020

- Certified Accounts Receivable Professional (CARP)

- Institute of Financial Operations, 2021

Professional Memberships:

- Member,

- American Institute of CPAs (AICPA)

- Member,

- Institute of Management Accountants (IMA)

Volunteer Experience:

Treasurer, Local Animal Shelter

2019-Present

- Oversee budgeting and financial management for nonprofit organization, enhancing financial reporting accuracy by 40%.

Incorporating these additional sections into your resume not only provides a more rounded picture of your professional and personal interests but also underscores your multifaceted skill set and dedication to the field of finance. These details can be the deciding factor in making your resume stand out in a competitive job market.

Mastering the Cover Letter for Accounts Payable/Receivable Positions

Crafting a compelling cover letter is just as crucial as your resume when applying for accounts payable/receivable roles. Your cover letter offers the chance to elaborate on your qualifications, express your enthusiasm for the position, and make a personal connection with the hiring manager. Here’s how to create a cover letter that complements your resume and enhances your application.

Personalize Your Introduction

Begin with a personalized greeting to the hiring manager. If possible, find out their name to make your letter more engaging. In your opening paragraph, mention the specific accounts payable/receivable position you're applying for and express your excitement about the opportunity to contribute to the company.

Highlight Key Experiences and Skills

Use your cover letter to delve deeper into experiences and achievements that align with the job description. Pick one or two significant accomplishments from your resume and expand on them, explaining the context, your actions, and the outcomes. This is your opportunity to tell a story that illustrates your capabilities and work ethic.

Demonstrate Your Knowledge of the Company

Show that you've done your homework by mentioning something specific about the company that attracts you to the position. Whether it’s their industry reputation, commitment to innovation, or community involvement, make it clear why you want to be part of their team.

Conclude with a Strong Closing Statement

End your cover letter with a call to action, expressing your eagerness to discuss how you can contribute to the company in more detail. Thank them for considering your application and include a polite sign-off.

Example of a Cover Letter Introduction for an Accounts Payable/Receivable Role

I am writing to express my interest in the Accounts Payable Specialist position at SolarTech Innovations, as advertised on your careers page. With over 5 years of experience in managing comprehensive accounts payable operations and a track record of significantly improving payment processes, I am excited about the opportunity to contribute to your team’s success. Your company’s innovative approach to renewable energy solutions and dedication to sustainability resonate with my professional values and goals.

Your cover letter is a crucial tool in making a memorable first impression. By carefully tailoring it to the job and company, you can significantly increase your chances of landing an interview. Show your passion for the role and the value you can bring to the team, and you’ll be on your way to securing your next position in the accounts payable/receivable field.

Concluding Insights: Standing Out in Accounts Payable/Receivable Job Applications

As we wrap up this comprehensive guide on crafting a standout resume and cover letter for accounts payable/receivable positions, remember that the goal is not just to list your experiences and skills but to tell a compelling story that showcases your value as a candidate. Here are some final thoughts and tips to ensure your application makes a lasting impression:

Tailor Your Application

Customize your resume and cover letter for each position you apply for, highlighting the experiences and skills that are most relevant to the job description. This tailored approach shows employers that you've put thought and effort into your application and that you're genuinely interested in the role.

Showcase Your Achievements

Quantify your accomplishments wherever possible. Numbers and data provide concrete evidence of your impact in previous roles and help hiring managers understand the scale and scope of your abilities.

Stay Up-to-Date

In the ever-evolving field of finance, staying current with industry trends, software, and regulations is crucial. Mention any recent training or certifications you've completed to demonstrate your commitment to continuous learning and professional development.

Proofread Carefully

Errors and typos can undermine the professionalism of your application. Review your resume and cover letter several times, and consider asking a trusted friend or mentor to proofread them as well.

Follow Up

After submitting your application, consider sending a brief follow-up email to express your continued interest in the position and to reiterate how you can contribute to the company. A polite and professional follow-up can keep you top of mind for the hiring manager.

Example Key Takeaway for Your Accounts Payable/Receivable Application

Applying these strategies will help you develop a strong, impactful application that stands out. The finance sector is competitive, but with a thoughtful and focused approach, you can showcase your strengths and position yourself as a highly desirable candidate for accounts payable/receivable roles.

FAQ: Crafting an Impactful Resume for Accounts Payable/Receivable Positions

Creating a resume for accounts payable/receivable positions can raise several questions, especially regarding how to highlight your skills and experiences effectively. Below are answers to some frequently asked questions that can help you refine your resume and cover letter for these roles.

Q1: How Do I Make My Resume Stand Out for an Accounts Payable/Receivable Position?

- Customize Your Resume: Tailor your resume to the job description, using keywords and phrases from the posting. Highlight the experiences and skills that are most relevant to the role.

- Quantify Achievements: Use numbers and data to illustrate your accomplishments, such as reducing invoice processing times or improving collection rates.

- Showcase Relevant Software Skills: Highlight your proficiency in accounting software and tools that are pertinent to the role, such as QuickBooks, SAP, or Oracle Financials.

Q2: Can I Include Part-Time Work or Internships?

Absolutely. Part-time positions, internships, and volunteer work can demonstrate valuable skills and experiences, especially if they are relevant to the accounts payable/receivable field. Be sure to highlight any specific projects or responsibilities that showcase your capabilities.

Q3: How Important Is the Cover Letter?

Very Important. A cover letter is your opportunity to tell a more detailed story about your professional journey and how you can add value to the company. It allows you to explain your interest in the position and the company, and to highlight your most relevant achievements and skills.

Q4: What If I'm Changing Careers?

Focus on Transferable Skills: Highlight skills and experiences from your previous career that are relevant to accounts payable/receivable roles, such as analytical abilities, experience with financial documentation, or proficiency in specific software.

Q5: How Often Should I Update My Resume?

Regularly. Keep your resume updated with any new skills, experiences, or achievements. Even if you're not actively job searching, a current resume is useful for networking opportunities and professional development.

Q6: How detailed should my work experience be on my resume?

A: Your work experience section should provide a clear and concise overview of your roles and achievements. Focus on responsibilities and projects that are most relevant to the accounts payable/receivable position you're applying for. Use bullet points to make this section easy to read, and quantify your achievements to demonstrate your impact.

Addressing these common concerns can help you craft a more effective and targeted resume for accounts payable/receivable positions, increasing your chances of catching the eye of hiring managers and advancing in the hiring process.

Recommended Reading